“Too many American communities have been left behind by widening geographic disparities and increasingly uneven economic growth. We come from different parties and regions, but share the common conviction that all Americans should have access to economic opportunity regardless of their zip code.”

-Senators Scott and Booker & Congressmen Tiberi and Kind joint statement, 2/2/2017

Senators Tim Scott (R-SC) and Cory Booker (D-NJ) and Congressmen Pat Tiberi (R-OH) and Ron Kind (D-WI) introduced the Investing in Opportunity Act (H.R.828/S.293) to help revitalize economically distressed communities suffering from a lack of investment and new business growth.

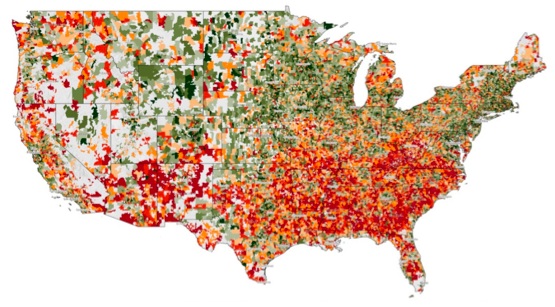

Today, the map of economic growth is becoming increasingly uneven, and more than 50 million Americans live in a distressed community that has seen continued loss of jobs and businesses — in spite of the national economic recovery. Meanwhile, American investors have trillions of dollars of inactive capital that, if reinvested, could be an important new source for catalyzing growth and opportunity in communities in every state. These new dollars could help stem the tide of business closures, restore access to capital for emerging enterprises, and rekindle entrepreneurship in areas that need it most.

The Investing in Opportunity Act encourages new investment in distressed communities by:

- Allowing investors to temporarily defer capital gains recognition if they reinvest into an “Opportunity Zone.” U.S. investors currently hold an estimated $2.3 trillion in unrealized capital gains on stocks and mutual funds alone — a significant untapped resource for economic development. This legislation allows investors to temporarily defer capital gains recognition from the sale of an appreciated asset, but only if they reinvest the gains into qualified assets in an Opportunity Zone. This will remove the tax disincentive for investors to roll assets into distressed communities, and preserve a larger amount of capital for investment in such areas.

- Encouraging investors to pool resources and risk in “Opportunity Funds” (O Funds). Many investors are willing to provide the capital, but lack the wherewithal to locate and execute investment opportunities in communities that need it. These new O Funds will democratize economic development by allowing a broad array of investors throughout the country to pool resources and mitigate risk, increasing the scale of investments going to underserved areas and thereby increasing the probability of neighborhood turnaround. O Funds would be required to invest 90 percent of their resources in qualifying Opportunity Zones.

- Encouraging local responsibility for designating Opportunity Zones. This legislation uses “low income community” census tracts as the basis for defining areas eligible to be designated an Opportunity Zone. Governors will be able to designate up to 25 percent of the total number of qualifying census tracts and all areas will have to meet the required threshold of economic distress. This approach will help ensure local needs and opportunities are being met as well as encourage concentration of capital in targeted, geographically contiguous areas in each state.

- Incentivizing long-term investment via a modest reduction in capital gains taxes owed on the original investment after holding qualified investments for five to seven years. Patient capital is further rewarded by exempting qualified investments held for more than 10 years from additional capital gains recognition beyond that which was originally deferred.

The legislation is designed to be low cost and low risk to the taxpayer. Investors bear the risk and are on the hook for all of their originally deferred capital gains, minus a modest reduction for long-term holdings, regardless of whether subsequent investments have increased or decreased in value. There are no tax credits and no public sector financing is involved.