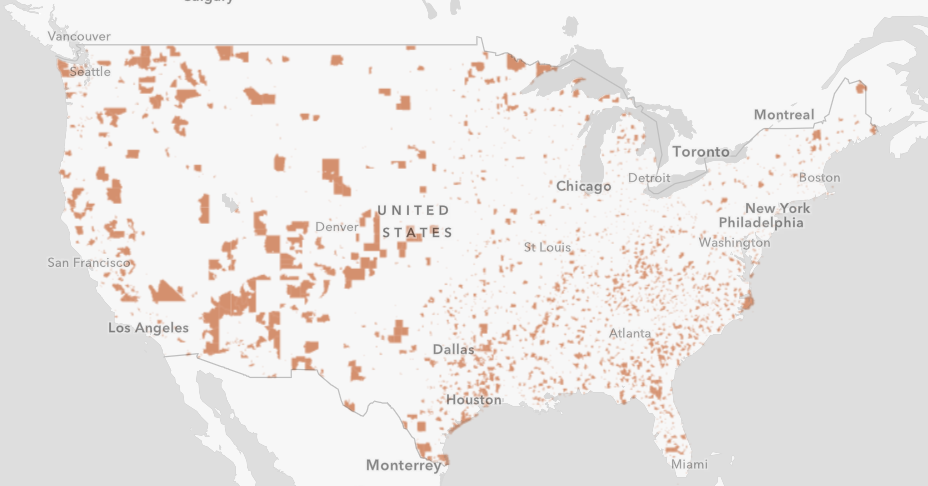

The U.S. Department of the Treasury today issued proposed regulations related to Opportunity Zones, which were established as part of the Tax Cuts and Jobs Act of 2017. Under the law, businesses and individuals are eligible for tax benefits on capital gains reinvested in the 8,700 low-income communities designated as Opportunity Zones across all 50 states, the District of Columbia, and the U.S. territories. According to Economic Innovation Group estimates, U.S. taxpayers held over $6 trillion in unrealized capital gains in stocks and funds as of the end of 2017.

President and CEO of the Economic Innovation Group, John Lettieri, said, “These proposed rules are a welcome and significant first step in providing regulatory clarity for Opportunity Zones. As a result, investors have greater certainty in a number of areas, and can more readily raise and deploy capital, bringing benefits to more distressed communities. As the process moves forward, EIG will continue to work with the administration and stakeholders around the country to ensure this policy spurs more capital investment in distressed communities and has a lasting positive impact in the places that need it most.”

On October 3, 2018, Lettieri testified before the Senate Small Business and Entrepreneurship Committee on “Expanding Opportunities for Small Businesses Through the Tax Code.” He described three “threshold issues” that Treasury should address as part of the rulemaking process including definitional clarity, timing clarity and benefit clarity.

In his testimony, Lettieri wrote:

“Opportunity Zones are the most innovative and ambitious federal attempt to encourage long-term private investment in low-income communities in at least a generation. While the incentive was designed to support a wide variety of needs across communities, its central purpose was to drive investment into operating businesses in underserved areas – particularly new ventures and existing small- to medium-sized businesses poised for growth….

My primary hope for Opportunity Zones implementation – one shared by state and local officials, community organizations, and investors alike – is that it will succeed where other policies and programs have fallen short: by providing a true lifeline to entrepreneurs in underserved and overlooked areas of our country. I firmly believe this goal is within reach.”

About the Economic Innovation Group (EIG)

The Economic Innovation Group (EIG) is an ideas laboratory and advocacy organization whose mission is to advance solutions that empower entrepreneurs and investors to forge a more dynamic American economy. Headquartered in Washington, D.C. and led by an experienced, bipartisan team, EIG convenes leading experts from the public and private sectors, develops original policy research, and works to advance creative legislative proposals that will bring new jobs, investment, and economic growth to communities across the nation. For more information, visit eig.org.