By August Benzow and Nora Esposito

The U.S. economy is falling into a recession of unprecedented nature. Many of its consequences will be unpredictable, but the devastation it threatens to wreak on small businesses is quite clear. Research on the Great Recession has shown that women-owned, minority-owned, and young businesses were disproportionately impacted by that crisis. Today’s circumstances are different, but the underlying vulnerability of such firms has persisted.

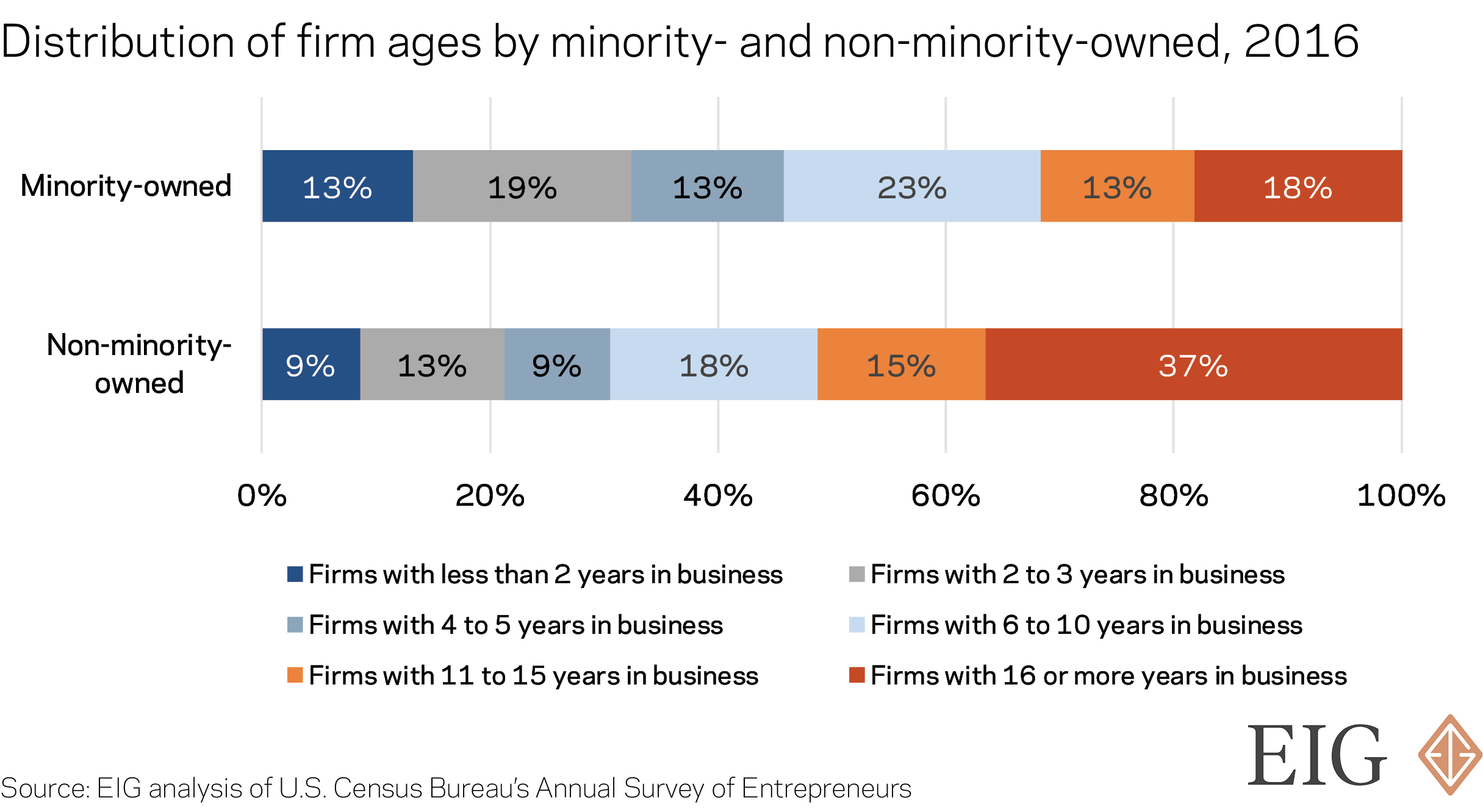

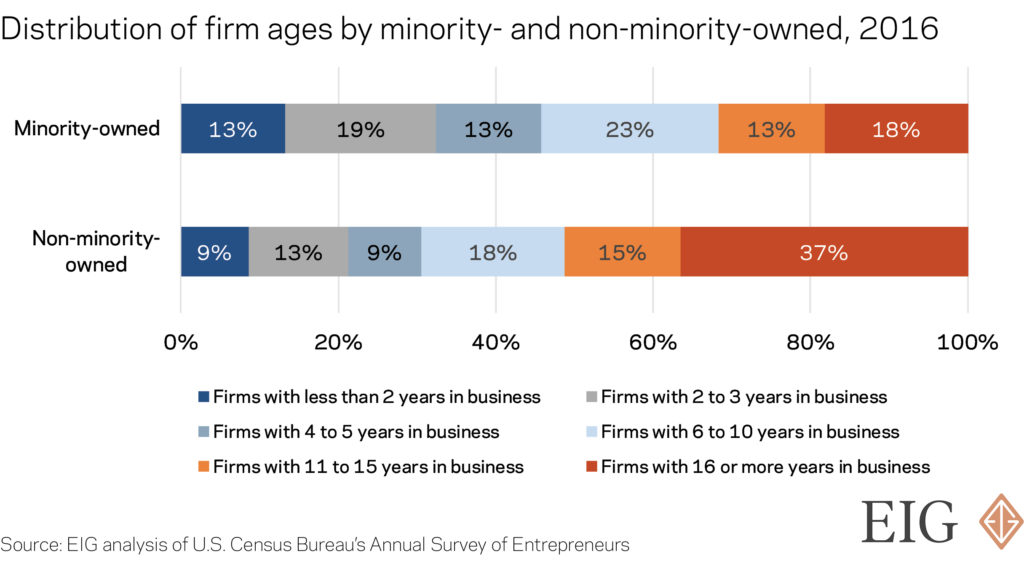

Data from the U.S. Census Bureau’s 2016 Annual Survey of Entrepreneurs, the most recently available data on business owner demographics, shows that minority-owned businesses are younger than non-minority- owned businesses. This may put them at greater risk as a new recession takes hold, given the high rates of failure among young firms even in good times. In 2016, just 49 percent of new businesses lasted longer than five years, a modest improvement from 43 percent in 2011 at the Great Recession’s low point, but still startlingly high. A full 32 percent of minority-owned businesses are under 5 years old, compared to 22 percent of non-minority-owned businesses. At the other end of the age distribution, 37 percent of non-minority-owned businesses are 16 years or older compared to just 18 percent of minority-owned businesses. The same economic disadvantages facing minority entrepreneurs, such as community wealth gaps and access to markets, likely affect the longevity of minority-owned businesses as well.

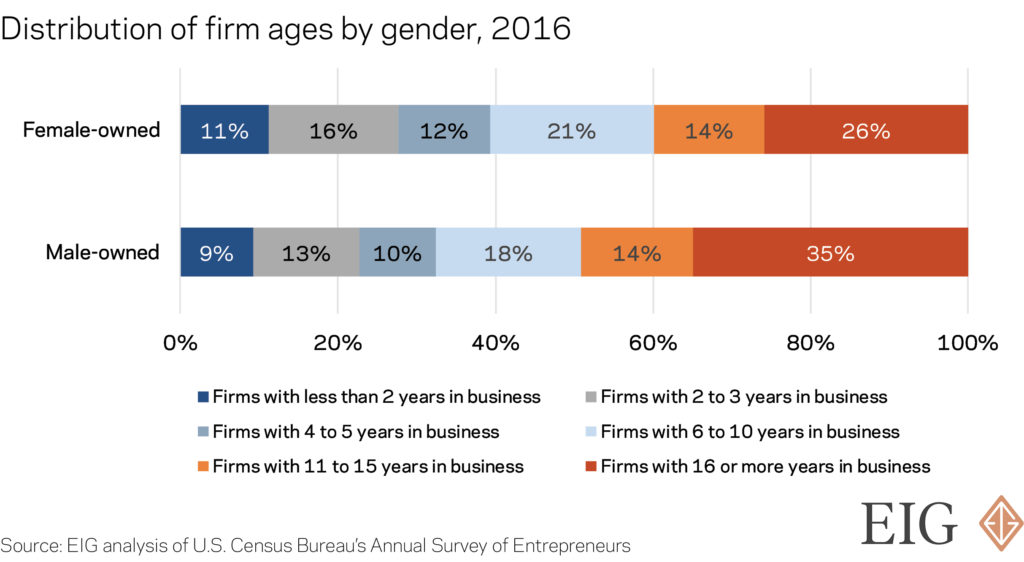

A less stark version of the same pattern is noticeable comparing female-owned businesses to male-owned ones. Women tend to own younger businesses than men, as 27 percent of female-owned businesses have been in operation less than 5 years, compared to 22 percent of male-owned businesses. This higher share of younger businesses owned by women may be driven in part by women starting businesses at a higher rate than men, a relatively recent development.

August Benzow is a Research and Policy Analyst and Nora Esposito is a Research and Policy Fellow at the Economic Innovation Group.