by Connor O’Brien

The pandemic roiled nearly every corner of the American economy, and the housing market was no exception. Plummeting immigration, new patterns of geographic mobility, high inflation, massive federal economic stimulus, and a booming jobs market have all had varying effects on the housing market and housing affordability. Incomes have rapidly recovered from the pandemic’s shocks, but the housing market, too, has been red-hot.

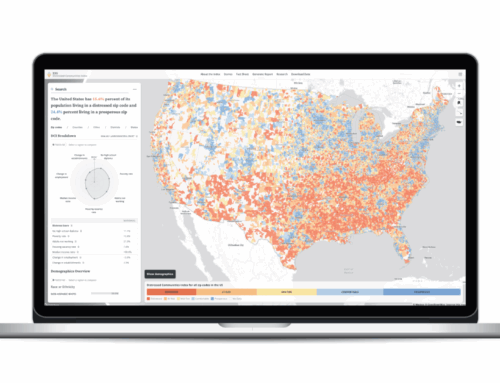

New estimates from the American Community Survey (ACS) allow us to explore for the first time how well household incomes kept pace with rising rent and mortgage costs between 2019 and 2021 at granular geographic levels. The data reveals deteriorating affordability across the country, particularly for renters and households in most major cities.

The number of households burdened by high housing costs rose by 3 million from 2019 to 2021

The most common rule of thumb for housing affordability is the so-called “30 percent rule,” which suggests renters or homeowners should spend no more than 30 percent of their gross monthly income on housing. Above this ratio, households are considered cost-burdened. According to the most recent one-year estimates from the American Community Survey, 3 million more households were excessively burdened by housing costs in 2021 than in 2019, an increase of 7.9 percent. Overall, 31.6 percent of households in the United States were excessively burdened by housing costs in 2021, up from an estimated 30.2 percent in 2019.

Despite the turbulent pandemic economy that saw families fleeing dense coastal cities for smaller and more affordable inland cities, suburbs, and recreational remote work hubs, high-priced coastal states remained expensive. In California and Hawaii, over 41 percent of households were cost-burdened, up slightly from 2019. New York, DC, and New Jersey round out the list of states with the most cost-burdened households, none of which have improved on this measure since the beginning of the pandemic.

While unaffordability grew in these high-cost states, some of the biggest increases in cost-burdened households were in the interior of the country. In Alabama, there was a 20.3 percent increase in households spending 30 percent or more of their incomes on housing just between 2019 and 2021. In Missouri, this number rose 19 percent. In these states, income growth was unable to keep up with the growth in rents and house prices. In Alabama, for instance, median rents climbed 6.7 percent between 2019 and 2021, but the median renter’s income grew just 4.9 percent.

New Hampshire and Montana stand out as exceptions, with the level of cost-burdened households outright declining in these states. Though growth in median rents was much higher in New Hampshire (10.1 percent) than Alabama or Missouri, the nominal income of its median renter grew 17.8 percent between 2019 and 2021. Montana and New Hampshire both saw big increases in the share of their populations making at least $100,000, due to a combination of wealthy new arrivals, out-migration of low-income households, and income growth among people who remained.

Renters faced the brunt of declining housing affordability

Home price growth has outpaced rent growth since the start of the pandemic, though both have increased dramatically. Still, renters have been more broadly exposed to affordability pressures for two reasons: first, the average renting household makes little more than half the average home-owning household (the renter population skews younger, too); second, renters, perhaps unsurprisingly, move more often, making them more exposed to real-time changes in market conditions than homeowners with fixed-rate mortgages. Between 2020 and 2021, 7.8 percent of home-owning households moved compared to 20.8 percent of renting households. A larger share of renters have been exposed to the run-up in housing prices and, limited by lower incomes, face greater affordability challenges.

In 2019, 47 percent of renters spent 30 percent or more of their incomes on housing compared to 22 percent of homeowners. This difference became more lopsided over the course of the pandemic, even as home prices increased at a faster pace than rents nationwide. In 43 states, the share of cost-burdened renters rose faster than the share of cost-burdened homeowners.

The share of renters burdened by housing costs rose 2.5 percentage points, or 1.1 million new households. At the same time, the number of affordable units costing less than 20 percent of household income fell by nearly 800,000. These increases were broadly felt throughout the country, as 80 percent of counties with 50,000 or more occupied rental units saw an increase in cost-burdened renters. Exacerbating the effects of shifting demand for rentals is the country’s long-running shortage of housing, which Up For Growth estimates to be nearly four million units.

Though a smaller fraction of homeowners entered the market during the pandemic than renters, those who did felt the squeeze of higher prices. Homeowners who did not buy a house during the pandemic may have also become cost-burdened if, for instance, the pandemic economy upended their industry and their incomes fell. Overall, two million more homeowners were cost-burdened in 2021 compared to 2019, an increase of nearly 12 percent. Many of the country’s booming counties—particularly suburbs outside major cities and smaller urban areas—saw even more rapid declines in affordability. Henry County, Georgia, a majority-Black suburb south of Atlanta, saw an 88 percent increase in cost burdened homeowners just between 2019 and 2021. In places as varied as Anchorage, Alaska (40 percent), Lake County, Florida (55 percent), Jackson County, Oregon (38 percent), and Hampden County, Massachusetts (32 percent), spiraling home prices left many more homeowners facing unaffordable housing costs.

Increased household formation may be contributing to affordability woes

After an initial consolidation of households during the early months of the pandemic, a period in which many young adults moved back in with their parents, 2020 and 2021 saw faster-than-usual household formation. Between 2019 and 2021, the number of occupied housing units nationwide grew by over 4.7 million, a much faster clip than before the pandemic and one almost entirely driven by owner-occupied units.

A portion of this growth was new construction, which reached its highest rate in 2021 since before the Great Recession. Another driver was falling vacancies. Nationwide, there were nearly 2.3 million fewer vacant housing units in 2021 than in 2019, and the national vacancy rate dropped roughly two percentage points to 10.3 percent.

Overall, this splitting up of households may have exacerbated affordability woes. First, younger people separating for the first time or once again from a parents’ household will tend to have lower incomes. Second, this splitting up acts as a new source of demand in a still-constrained building sector. On the other hand, it also is a manifestation of robust income growth, as some, perhaps younger, members of households feel confident enough financially to venture out on their own.

Many costly metros continued to get less affordable over the pandemic

The nationwide affordability crisis gripping many of the country’s largest cities did not let up in 2021, despite the pressures from remote work and an initial flight to the suburbs and exurbs early in the pandemic. Though these forces likely depressed demand for housing in major cities, continued supply shortages along with high incomes and frothy real estate markets helped buoy price levels such that the number of cost-burdened households nevertheless rose faster in urban counties than the rest of the country. The number of cost-burdened families and households in large urban counties rose 9 percent between 2019 and 2021, modestly faster than the 7.9 percent increase nationwide.

In New York City, the affordability picture substantially worsened in 2021, even as the city struggled to reopen businesses and attract newly-remote workers back to the office in the first half of the year. In Manhattan, the share of households that were cost-burdened rose 7.7 percentage points from 2019—from 37.5 to 45.2 percent—though this is in part due to a substantial share of affluent residents leaving the borough. Though the share of households paying more than 30 percent of their income did not rise in the Bronx in 2021, its share remained steady at a shocking 56 percent, the highest of any large urban county in the country. Elsewhere on the East Coast, affordability deteriorated in Suffolk County, Massachusetts (Boston), the District of Columbia, Baltimore, and smaller urban counties like Essex County, New Jersey (Newark) and Alexandria, Virginia.

On the West Coast, San Francisco—which experienced even more dramatic population losses in 2020 and the first half of 2021 than New York—saw its median rent rise $200 per month and the share of cost-burdened households jump from 31 to 37 percent.

The erosion of housing affordability was not limited to the coasts, however. Booming interior counties also saw large increases in cost-burdened households, such as Maricopa County, Arizona (+12.4 percent), Davidson County, Tennessee (+24 percent), Travis County, Texas (+10.3 percent), and Fulton County, Georgia (+10.6 percent).

Not all large urban counties saw declines in affordability. In St. Louis, the number of cost-burdened households declined 8.4 percent and in Marion County, Indiana, centered around Indianapolis, this number dropped 8 percent. Nevertheless, these exceptions were rare.

Initial post-pandemic figures may understate the growing affordability problem

The American Community Survey’s housing data is imperfect, capturing yearly averages rather than point-in-time estimates. Given the stark difference between the macroeconomy of January 2021 and December 2021, the survey’s estimates may understate the growing affordability problem across the country. It is likely that the large-scale urban flight in 2020 and the first half of 2021 attenuated in the second half of the year, though just how much it did remains to be seen.

At the same time, housing prices continued to rise in the first half of 2022. The Zillow Home Value Index, for example, estimates that the average home price across the United States has risen from $327,000 in January to $356,000 in August, while Zillow’s estimate of a typical market rent has risen a further 7.2 percent from January. Inflation in housing, shelter, and rent is accelerating, piling onto the erosion of American workers’ recent income growth.

In the months ahead, the affordability picture may change as home prices begin to decline but mortgage costs climb higher in response to the Federal Reserve’s interest rate hikes. But evidence thus far indicates that the nation’s long-simmering housing affordability problem was only exacerbated by the changes and disruptions of the pandemic and recovery.