By Rachel Reilly

On April 16, the Economic Innovation Group hosted a webinar with guest speaker Bruce Katz, Director of the Nowak Metro Finance Lab at Drexel University, to discuss emergency relief efforts to support small businesses and highlight recent economic trends and initiatives that can inform our long-term response.

View a recording of the webinar and slides from the presentation.

Key Takeaways:

- EIG has recommended improvements to the Paycheck Protection Program to address the need for greater scale and flexibility. An adequate policy response must ensure the survival of small businesses so that the millions of Americans they employ have jobs to return to once mandatory closures are lifted.

- (Update: April 21 letter to Congress with leading associations and organizations representing the industries and small businesses most deeply affected by COVID-19.)

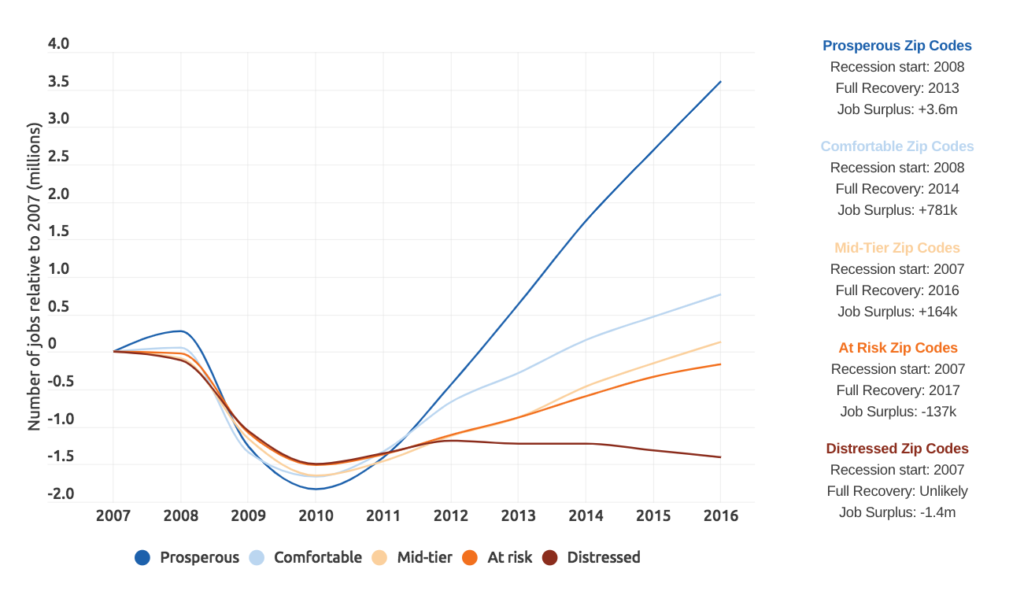

- Economic growth in the years following the Great Recession has been concentrated, leading to a growing gap between prosperous communities and others. The median American community has not healed from the trauma of the Great Recession, and the death of small businesses in these towns will further impair prospects for prosperity.

Change in employment by quintile since 2007

- Women-owned, minority-owned, and young businesses were disproportionately impacted during the Great Recession; new business formation, small business lending, and new bank formations never recovered in the years following. A robust and inclusive recovery is predicated on addressing the immediate liquidity and long-term solvency needs of these small businesses and entrepreneurs.

- Place-based emergency relief funds have been created in the last month to provide a lifeline to small businesses. Throughout the nation, demand for assistance immediately outstripped funds available due to the overwhelming and unprecedented need. For example, 90% of Salt Lake City’s 17,000 businesses have 50 employees or less and were eligible to apply for the city’s emergency loan program, which was ultimately overscribed by 13X. Members of Congress are considering a proposal to appropriate relief dollars to cities and states, which could be used to recapitalize existing or modified local funds.

- Some places that swiftly deployed emergency relief through funds, did so by repurposing existing networks of institutions focused on other economic development goals. First-mover cities Erie, Indianapolis, and Birmingham were also early adopters of Opportunity Zones. OZ initiatives in these cities and others have strengthened and diversified local networks, better positioning communities to meet the need of this moment.

- As cities and states begin to develop stabilization and recovery strategies grounded in maximizing precious resources, incorporating the pillars of successful OZ initiatives could better position communities for long-term solvency and economic growth. This includes taking a data-driven, asset-based approach when identifying local priorities, finding new ways to foster community engagement, and engaging anchor institutions and major employers.

Featured Feedback:

Thank you for hosting the Webinar yesterday. You and Bruce bought up great ideas, solutions and paths to our recovery. Many hands make the work load light, add capital and things start really moving back toward normal. Looking forward to the follow up.

— The Verdant Group (@Christo44516743) April 17, 2020

EIG’s OZ Webinar Series:

This webinar is the twelfth in a series hosted by EIG to provide Opportunity Zones strategies and insights from around the country. Topics include an introduction to Opportunity Zones, an analysis of the final regulations, emerging best practices in heartland, rural, tribal and Main Street areas, and examples of OZ activity in operating businesses, in affordable housing, and from local anchor institutions.

Rachel Reilly is the Director of Impact Strategy of Economic Innovation Group