By Catherine Lyons

This week, Congress passed and sent to the president’s desk a spending package of historic proportions, totaling more than $2 trillion to fund the government through fiscal year 2021 and provide relief in response to the coronavirus pandemic. The Coronavirus Response and Relief Supplemental Appropriations Act—Division M of the more than 5,500 page bill—includes $325 billion of much-needed small business relief. The legislation allows for a second draw of Paycheck Protection Program (PPP) loans for hard-hit businesses that can demonstrate a significant revenue loss, creates a $15 billion grant program to support operators of shuttered arts and entertainment venues, provides additional funding to the Economic Injury Disaster Loan (EIDL) Advance program for businesses in low-income communities, and makes some important changes to the initial PPP, among other provisions.

While a new round of small business support is certainly welcome news, Congress has once again opted for a short-term approach that is all but guaranteed to run out before the economy returns to normal. Small businesses in hard-hit sectors are almost certain to need additional relief after this round of PPP ends on March 31, 2021. As made clear in a December 7 letter to congressional leadership from EIG and an array of business and policy organizations, PPP provides critical stop-gap relief for small businesses, but longer-term relief is needed to help the small business sector transition from crisis to recovery. We urge Congress to enact a longer-term relief program when it returns in 2021.

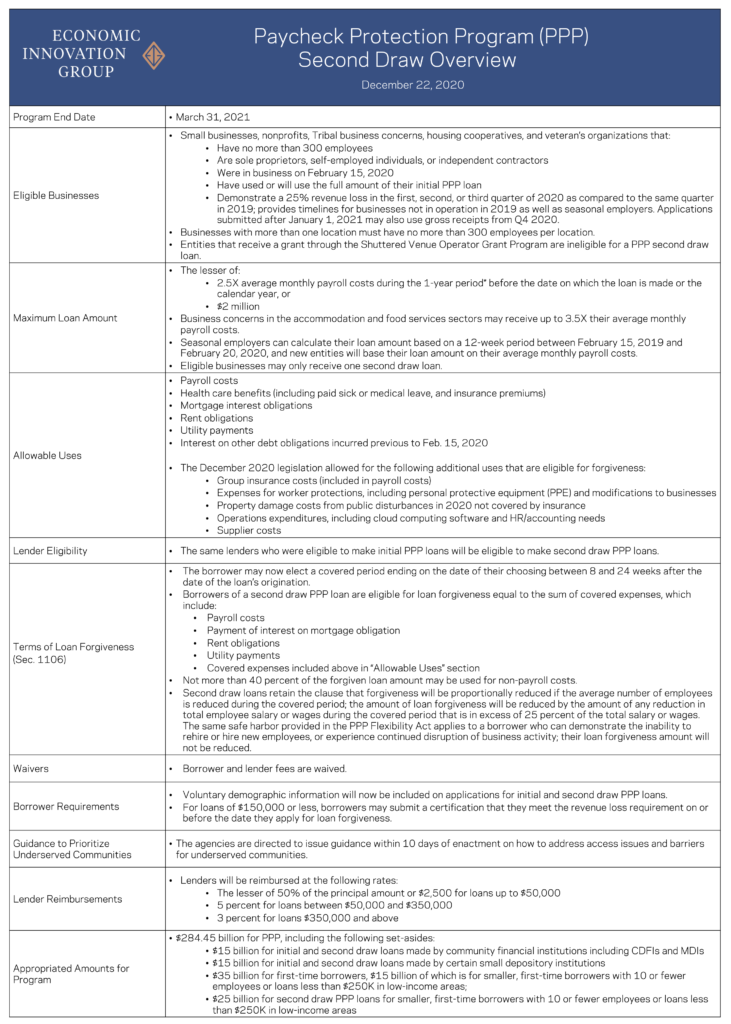

The chart below outlines the details for second draw PPP loans. Additionally, the legislation makes some significant changes to the initial PPP.

Changes to the Paycheck Protection Program

The legislation makes the following improvements to the PPP:

- Expands eligible entities to certain 501(c)(6)s and destination marketing organizations with 300 or fewer employees that do not receive more than 15 percent of their revenues from lobbying activities. Also included are local TV, newspapers, and radio stations that were previously deemed ineligible because of affiliation rules, as well as housing cooperatives with no more than 300 employees.

- Prohibits entities that receive a Shuttered Venue Operator Grant from receiving a PPP loan.

- Expands covered and forgivable expenses to include supplier costs (including perishable goods), costs associated with ensuring worker safety (i.e. Personal Protective Equipment (PPE), air filtration systems, facility modifications, etc.), property damage caused by the public disturbances of 2020 and not covered by insurance, and operations expenditures such as cloud computing and accounting or HR systems. Group insurance costs are also deemed part of payroll costs.

- Provides a simplified forgiveness application process for loans under $150,000 and requires SBA to submit a report to Congress within 45 days outlining their forgiveness audit plan.

- Allows for a more flexible forgiveness period; borrowers can now choose their forgiveness period between 8 and 24 weeks after the loan’s origination date.

- Allows borrowers that returned some or all of their PPP loans to reapply for the full amount, as long as they have not yet received forgiveness.

- Eliminates the requirement that EIDL advances be deducted from PPP forgiveness amounts.

- Holds lenders harmless if they completed a loan in good faith and followed all regulations and requirements.

- Provides more guidance for farmers and ranchers to participate in PPP.

- Further defines the term “seasonal employer.”

- Requires PPP loan applications to include voluntary demographic information.

- Establishes a procedure in the bankruptcy process for entities the Administrator deems eligible for PPP loans but are in Chapter 11.