In the wake of the Great Recession, seed money for entrepreneurs has mostly gone to a very few locations, but the good news is that this is beginning to change. A little.

July 27, 2016

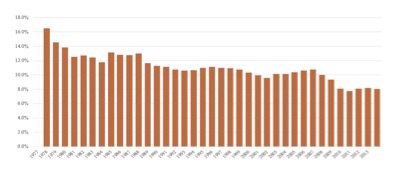

Entrepreneurs perhaps never have been more celebrated in American culture than they are today. But that popularity is at odds with a startling long-term trend: The U.S. economy has been getting less entrepreneurial for decades. From 1977 to 2013, startups as a share of all firms fell from 16.5 percent to 8.0 percent. The decline is pervasive across all sectors, including high tech.

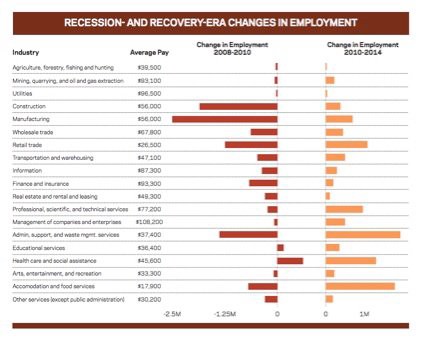

The map of entrepreneurship is shrinking, too. Since the recession, start-up activity has become much more highly concentrated in a few super-performing geographic areas. Consider this: fully half of the national increase in business establishments from 2010 to 2014 occurred in only 20 counties, 17 of which were located in just four states: California, Florida, New York, and Texas. Many regions, including large swathes of the Rust Belt, are struggling to seed the new industries needed to replace the millions of manufacturing and construction jobs lost during the recession.

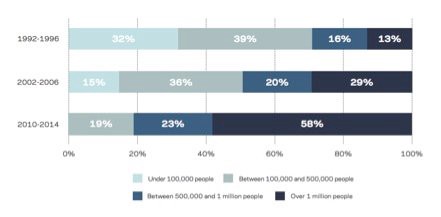

Size and density are driving much of the concentration. In the 1990s and 2000s, counties with more than 1 million people generated less than a third of net business formation. Today, those counties are responsible for almost 60 percent of the economy’s net new businesses — more than quadruple their 1990s share.

Why is this happening?

The concentration of capital is a key factor in reinforcing the geographic concentration of entrepreneurship. Cities like Boston, New York, and San Francisco have developed large and well-financed ecosystems dedicated to scaling promising new businesses. In turn, these cities attract the best and brightest entrepreneurs across America.

Businesses need capital to thrive and grow, but the Great Recession wiped out many of the most important traditional sources of startup financing, including home equity, personal savings, and personal credit. In addition, small business lending is down by one-quarter since before the financial crisis and more than one out of every four community banks has gone belly up since 2008.

What’s more, the map of venture capital — a critical source of funding for scaling promising new companies — is even more intensely concentrated: 78 percent of the nation’s venture capital goes to just three states: New York, Massachusetts, and California. Half of the country’s 366 metro areas saw no venture capital in 2015, and less than 4 percent of U.S. ZIP Codes received a single dollar.

But there are a handful of innovators who are working hard to expand the map and build a foundation for entrepreneurs everywhere. Revolution’s “Rise of the Rest” is a nationwide effort to support entrepreneurs in emerging startup ecosystems that rarely get national attention. Likewise, Village Capital uses an investment model designed to build communities of transformative startups in overlooked cities all over the country. And start-up incubator 1776 has used its Challenge Cup competition to find new companies and ideas taking root all over the world.

A handful of major investors, too, are proving how bold investments can transform even the most distressed communities throughout the country. Vivid examples include Dan Gilbert of Quicken Loans, Kevin Plank of Under Armour, Graham Weston of Rackspace, and Tony Hsieh of Zappos, who have collectively invested billions of dollars in underserved areas of Detroit, Baltimore, San Antonio, and Las Vegas, respectively — helping to fuel a new generation of homegrown entrepreneurs and new enterprises.

The decline of entrepreneurship threatens America’s advantage as the world leader in innovation. It’s a challenge that deserves attention from the public and private sectors alike. Just like we need pioneering investors, tackling this issue requires creative public policy ideas that connect capital with communities that have been left behind — places rich in potential but starved of investment.

This article originally appeared in The Daily Beast.