This week, our friends at 1776 released a new report — Innovation That Matters — ranking the top 25 U.S. cities in terms of how ready each is to take advantage of the growing digital economy. The rankings were based on the cities’ aggregate performance in dozens of key indicators, including successful startup exits and number of educated millennials. The study boils down what kind of innovation really matters: “First things first: All cities have a fundamental layer of challenges in common — get more people to start companies; find mentors to help companies grow and talent to fill open roles; and free available capital to fuel growth. Removing these roadblocks is the first, important step for every city.”

Importantly, the report identifies key trends that can inform the decision-making of all city leaders, whether they’re squarely in the top 25 or just starting to increase their economic competitiveness. One of the critical questions the study asks is: “Has the city mobilized adequate financial resources?”:

“Cities need people to build and execute on ideas, and they also need money to fund these ideas. To support innovation, cities need to attract venture funding, and they also need to have enough startups to grow, make money, and use that money to fund the next generation of entrepreneurs, recycling capital back into the community. In addition, they have to “unlock” their existing wealth by encouraging local investors to channel resources toward startups.”

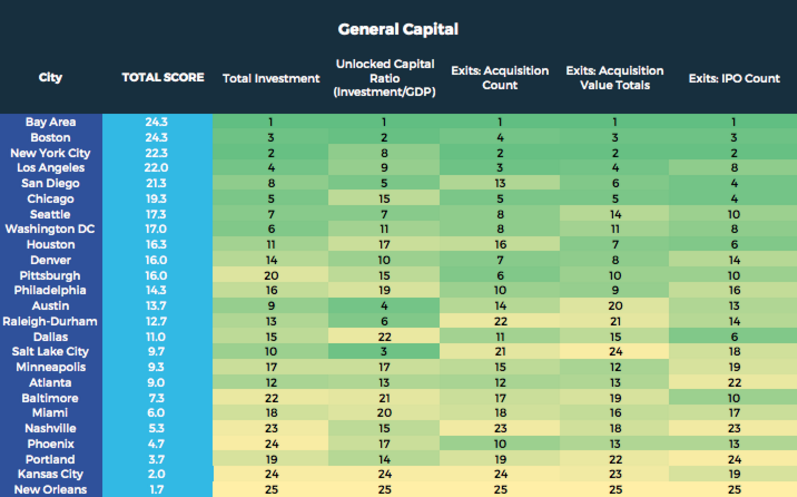

The following chart shows how well each of the 25 cities in the report have succeeded in unlocking capital for startup investment:

When you compare how cities score on this access to capital chart with their scores on EIG’s Distressed Communities Index, you get a clear correlation: less distressed cities have robust access to capital and more distressed areas see capital as a significant challenge.

But there’s good news for emerging digital cities in the report:

“Baltimore, Pittsburgh and New Orleans are not major drivers of the digital economy yet, but they are attracting educated young people, building collaborative innovation communities and creating the right cultural foundation to rise beyond recent challenges to stay relevant. Baltimore topped our connectedness survey. Pittsburgh best connected startups to local universities. New Orleans recorded the fastest increase in educated millennials.”

Reversing the decline in entrepreneurship is one of the great economic challenges of our time—one we must tackle to ensure opportunity is shared. And access to capital is one of the most important ingredients an entrepreneur needs to succeed, to allow their business to grow to scale. And we now know that 78% of all venture capital funding is concentrated in only three states.

That’s why EIG is working with policymakers from both sides of the aisle to ensure that more capital investment finds its way to all 50 states through the Investing in Opportunity Act. This legislation would create an innovative framework for getting idle capital off the sidelines to fund a new generation of entrepreneurs and enterprise in economically distressed areas of the country. Place matters, and unless we can find ways to stimulate new businesses and industries to take root in a broader cross section of America, we risk leaving huge portions of the country behind.