The latest and greatest research and commentary from the field.

This quarter’s reading guide reviews the latest hearings, reports, and commentary on all things entrepreneurship. It goes in-depth on communities underrepresented in the nation’s startup landscape and focuses on access to capital as well. Check out the book recommendations for some summer beach readings too.

Events and testimony

Hearing: America Without Entrepreneurs: The Consequences of Dwindling Startup Activity

U.S. Senate Committee on Small Business and Entrepreneurship

June 29, 2016

Read the testimonies:

John Lettieri of the Economic Innovation Group notes that “nothing is more integral to our nation’s cultural or economic identity than entrepreneurship” but warns that the shrinking geography of U.S. innovation portends a less dynamic, less productive, and less prosperous future characterized by widening geographic disparities.

Dane Stangler of the Kauffman Foundation disentangles structural and cyclical trends in business formation and finds many reasons for optimism. “Technology will continue to create, not destroy, more opportunities for entrepreneurship.”

Donna Harris of 1776 has found enormous entrepreneurial energy all across the country but worries that some startups can’t find the resources they need to survive and grow in their hometowns. “Sadly, location still matters far too much.” But there’s plenty we can do, from mentoring programs to boosting access to capital.

See also: U.S. Congress Joint Economic Committee Hearing: Encouraging Entrepreneurship: Growing Business, Not Bureaucracy, July 12, 2016

Remarks from President Obama and conversation with Mark Zuckerberg

Global Entrepreneurship Summit

June 24, 2016

President Obama discussed the universal allure and importance of entrepreneurship: “…When people can start their own businesses, it helps individuals and families succeed. It can make whole communities more prosperous and more secure. It offers a positive path for young people seeking the chance to make something of themselves, and can empower people who have previously been locked out of the existing social order — women and minorities, others who aren’t part of the “old boys” network — give them a chance to contribute and to lead.”

When people can start their own businesses, it helps individuals and families succeed. It can make whole communities more prosperous and more secure.

Reports

Kauffman Index of Growth Entrepreneurship

The Ewing Marion Kauffman Foundation

Spring 2016

This third release in Kauffman’s index series finds that “growth entrepreneurship” continues to recover from its Great Recession-lows thanks to robust hiring and more small companies growing into medium-sized ones. Thirty-nine states registered an increase in growth entrepreneurship activity. Across metro areas, Washington DC, Austin, San Jose, Columbus, and Nashville led the rankings, while Cincinnati and San Antonio advanced the fastest.

Defining the Record of High-Growth Firms by U.S. Metropolitan Region: What Happens to the Inc. 500?

Murray Rice, et al.

April 2016

This research tracks the performance of Inc. 500 firms from 2000 to 2008 by metro area. It finds that such high-growth firms have low failure rates and a majority remain independent 10 years on. It finds that M&A activity varies significantly by metropolitan area too, with firms in Boston and Austin registering the highest probability of becoming M&A targets. Other metro areas see higher than average failure rates, while Phoenix, Indianapolis, Washington DC, and Philadelphia lead their peers in consistently generating new cohorts of sustained high-growth firms.

Innovation That Matters

1776

Spring 2016

1776 evaluates 25 major U.S. cities for their readiness to capitalize on the transition to a digital economy. Boston edged out the Bay Area for the top spot thanks to the former’s cohesive community and latter’s declining quality of life. Denver and Raleigh-Durham ranked three and four due to their startup communities’ strong ties to local institutions, and San Diego rounded things out with its classic cluster attributes. Other cities stood out on different metrics, suggesting that the winners of the future are not pre-ordained.

Economic Survey of the United States

Organization for Economic Cooperation and Development

Spring 2016

The OECD’s survey of the U.S. economy explores the decline in business dynamism and its associated impacts on inequality, competition, and productivity in depth. It expresses notable concern that the decline in dynamism is slowing the diffusion of innovation and technology throughout the economy, resulting in lower living standards and stagnation in the country’s economic landscape.

Commentary

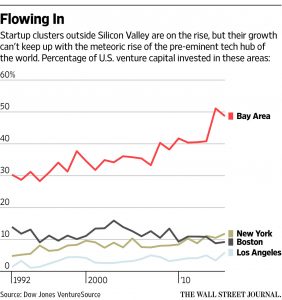

Startups Try to Spread Outside of Silicon Valley

Christopher Mims, The Wall Street Journal

July 11, 2016

Startup culture may be spreading to more and more cities, but the Bay Area’s dominance is only growing thanks to mutually reinforcing cycles of investment, returns, and reinvestment. In 1995, the Bay Area absorbed 35 percent of venture capital; in 2015, it received nearly 50 percent. The Bay Area now specializes in startups as an industry cluster in its own right: it has the managerial talent, the networks, the capital, and the know-how that startups need to scale and succeed.

Human Work in the Robotic Future: Policy for the Age of Automation

Andrew McAfee and Erik Brynjolfsson, Foreign Affairs

Summer 2016

The authors lay out a policy framework to help workers and society adapt to a future with a faster pace of disruption. Encouraging flexibility, fostering dynamism, and supporting work should be guiding lights.

The Myth of the Millennial Entrepreneur

Derek Thompson, The Atlantic

July 6, 2016

Young people may lead the country in entrepreneurship as a mentality, but when it comes to entrepreneurship as an activity, millennials have a lot of catching up to do. There’s a chance that the recession and its aftermath simply delayed millennial entrepreneurship, though. Millennials are still below peak entrepreneurship age, and they may be the best-prepared generation yet thanks to high rates of college attainment. “The Millennial generation may be like a dormant volcano of entrepreneurship that will erupt in about a decade… a vision of the future that is worth rooting for.”

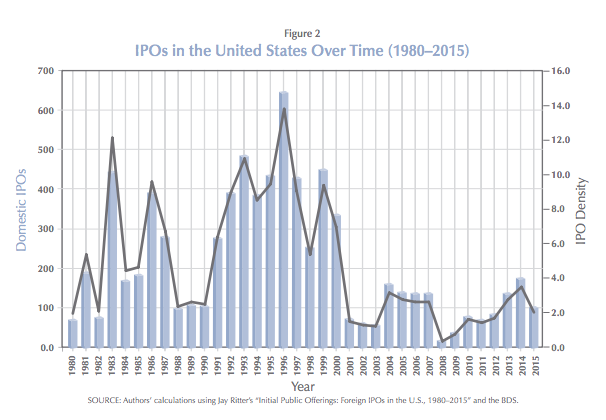

Why Startups Are Struggling

James Surowiecki, MIT Technology Review

June 15, 2016

The author endeavors to reconcile the prevailing perception that the United States finds itself in a golden age of entrepreneurship with the statistical reality of startups’ waning number and heft. The country has not necessarily lost its appetite for risk–the number of high-growth firms, which have the largest impact on innovation and growth, is recovering and several regional ecosystems are generating high-potential startups at historical highs–but success rates have fallen. “As many trees as ever are being planted. But fewer trees are growing to the sky.” The stakes are high: will incumbents or entrepreneurs control the future of technology?

How America Lost Its Mojo

Derek Thompson, The Atlantic

May 27, 2016

Americans are losing their frontier mindset and increasingly stuck in place. They’re less likely to switch jobs, start companies, or move. What could be the root cause of this dormancy? The cost of living in the country’s most productive cities, the author posits.

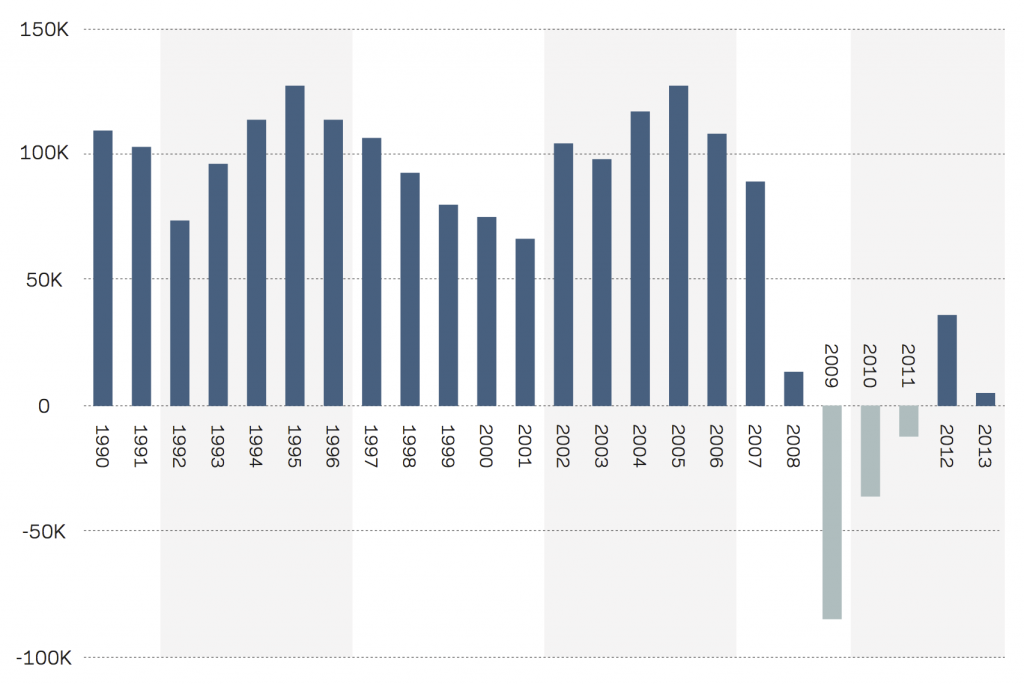

The Number of New Businesses in the United States Is Falling off a Cliff

Michael Coren, Quartz

May 24, 2016

The author explores two troubling trends in the economy that emerged from EIG’s latest report: the consolidation of prosperity into a few predominately urban locales and a decline in the type of startups that have long anchored middle-class prosperity.

The Big Advantage Superstar Cities Have Over Everyone Else

Jim Tankersley, The Washington Post

May 23, 2016

The author argues that uneven access to capital is fueling the widening geographic disparities that have characterized this recovery. The story is not only about high-growth firms and venture capital, although that’s a part of it; home values, an important source of equity for small-scale startups, remain depressed in second-tier markets, and small business lending still hasn’t recovered. Ultimately, the positive cycles of growth in places with robust entrepreneurial ecosystems ensure they keep racing ahead as other places with weaker networks fall behind.

Helping Entrepreneurs Succeed

Wendy Guillies, The Ripon Society

April 2016

The President of the Kauffman Foundation lays out five key policy recommendations for rekindling the nation’s entrepreneurial energy: 1) adapt existing regulations for the new economy and changing nature of work 2) reduce the opportunity cost of entrepreneurial experimentation by extending unemployment insurance to cover starting a business, for example, 3) boost the supply of entrepreneurs with a start-up visa 4) tackle incumbent bias throughout the economy and 5) support more data and research on entrepreneurship.

In-Depth: Entrepreneurship in Under-Served Communities

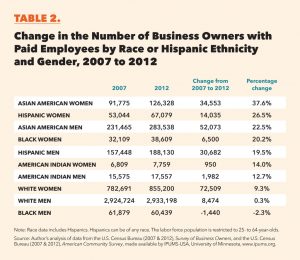

The Color of Entrepreneurship: Why the Racial Gap Among Firms Costs the U.S. Billions

Center for Global Policy Solutions

April 2016

Based on analysis from the Survey of Current Business Owners, the authors find that there was significant growth in the number of firms owned by entrepreneurs of color between 2007 to 2012, with Asian-American women experiencing the highest growth rate. Nevertheless, minority entrepreneurship remains severely depressed. The report finds that, if people of color owned businesses at the same rate as whites, the country would boast 1.1 million more employer-businesses and 9 million more jobs.

Creating Inclusive High Tech Incubators and Accelerators: Strategies to Increase Participation Rates of Women and Minority Entrepreneurs

Institute for a Competitive Inner City

May 2016

Business incubators and accelerators are a growing sector, yet women and minority entrepreneurs–the populations who stand to benefit the most from these assets–remain underrepresented relative to white men in such programs. Given that 43 percent of Millennials are people of color, the underrepresentation of minorities in incubators and accelerators is particularly troubling and points to the need for more inclusive models.

Expanding Veterans’ Opportunities to Become Entrepreneurs

State Science and Technology Institute

May 11, 2016

In the six years following World War II, 50 percent of returning veterans started their own businesses. Today, only 6 percent do, although far more express the desire. Bunker Labs, started in Chicago but now in eight other cities and expanding further, is trying to rebuild the social infrastructure of networks, mentors, and finance that helped empower veteran entrepreneurship in the past to create a path for today’s returning vets as well.

10 Million Strong: The Tipping Point for Women’s Entrepreneurship

National Women’s Business Council

October 2015

The Council’s annual report highlights the growing impact of women entrepreneurs on the economy while acknowledging the continued difficulties that women face in obtaining access to capital. Women-owned businesses are growing at nearly four times the rate of men-owned businesses, and women entrepreneurs are launching 1,200 new businesses per day. Yet women still face barriers to growing and scaling their businesses. The report concludes with a series of policy recommendations aimed at fostering a national entrepreneurial ecosystem that is more supportive of women business-owners.

Highlights from the most recent release of the Census Bureau’s Survey of Business Owners prepared by the National Women’s Business Council:

Fact Sheet: Small Business Ownership by Age

Fact Sheet: Women-Owned Businesses

Fact Sheet: Black Women-Owned Businesses

Profiles: Women-Owned Businesses by State

In-Depth: Access to Capital

Venture Capital Goes Urban And Rise of the Urban Startup Neighborhood

Richard Florida and Karen King, Martin Prosperity Institute

June 2016

The authors map venture capital investments by zip code and industry using detailed records from Pitchbook. They find that investments are moving downtown, with urban zip codes receiving 54 percent of venture dollars and suburban ones 45 percent. Their analysis also reveals incredible clustering down to the micro-geographic level: the top 20 U.S. zip codes–spread across only six metro areas–alone receive nearly one-third of the country’s venture funding. Investments by industry are similarly clustered.

Few Small Businesses Take Advantage of Mini-IPOs

Ruth Simon, The Wall Street Journal

July 6, 2016

The 2012 JOBS Act created new rules reducing the legal and reporting requirements of public offerings of up to $50 million in order to make it easier for smaller businesses to access capital in public markets. According to the SEC, only 94 companies have filed to raise funds under the regulation, and even fewer have been able to complete their offerings. Attracting enough investor interest is proving to be a major challenge.

Three Facts You Probably Didn’t Know About Venture Capital and Entrepreneurship

Arnobio Morelix, Growthology, a blog of the Kauffman Foundation

May 13, 2016

Kauffman researchers set out to capture venture capital’s true role in the country’s startup landscape. Less than 5 percent of startup funding comes from venture capital, but venture-backed companies make up 6.5 percent of high growth firms and 37 percent of IPOs. It therefore plays a disproportionate role in the economy even as personal savings, friends and family, and loans fund the bulk of the country’s startups–both high- and low-growth ones.

What Big Banks Can’t Do

Evan Absher, Growthology, a blog of the Kauffman Foundation

April 19, 2016

The author explains why local and community banks are so vital for entrepreneurship: They enable lending backed by social capital, institutional knowledge, and difficult-to-quantify information that can only be gleaned by face-to-face interaction. Such local connections between capital and startups are a key ingredient in vibrant ecosystems.

The Angel Market in 2015: A Buyer’s Market

Center for Venture Research

May 2016

While the total value of angel investments increased between 2014 and 2015 to $24.6 billion, the number of ventures that received funding and the number of active angel investors both declined. Just as with venture capital, the software, healthcare, and biotech industries were the top recipients of angel investments.

Books

Start-Up City: Inspiring Private and Public Entrepreneurship, Getting Projects Done, and Having Fun

Gabe Klein

2015

Drawing on his experience as both a former city transportation commissioner and a Zipcar executive, Klein details the need to cut through risk-averse government bureaucracy and imbue cities with the energy and fast pace of start-ups. His book provides a roadmap for how to get meaningful projects completed in a timely manner, creating more nimble cities in the process.

The Industries of the Future

Alec Ross

2016

As Senior Advisor for Innovation to the U.S. Secretary of State, Ross traveled to 41 countries in a tour of global entrepreneurship and innovation, an experience he details in this book. Ross looks ahead to the next ten years and offers insight on global trends and the fields that will most shape the future, including cybersecurity, big data, and robotics.

50 Billion Dollar Boss: African-American Women Sharing Stories of Success in Entrepreneurship and Leadership

Kathey Porter and Andrea Hoffman

2016

According to the American Express 2015 State of Women-Owned Businesses Report, African-American women are the fastest growing segment of entrepreneurs. 50 Billion Dollar Boss features 12 successful African-American women entrepreneurs who share their stories of success and discuss challenges and lessons learned.

Originals: How Nonconformists Move the World

Adam Grant

2016

Wharton professor Grant shares his insight into how innovators use creative thinking to successfully bring their ideas to market. The book weaves together studies and stories from a variety of industries to paint a picture of “how to champion new ideas and fight groupthink.”