On April 6, the Economic Innovation Group (EIG) hosted a webinar to discuss strategies for leveraging Opportunity Zones (OZ) financing to support affordable and workforce housing. During this webinar, guest speakers spoke directly to their success with pairing OZ equity with the Low-Income Housing Tax Credit (LIHTC) program to create new homes for extremely- and very-low income households.

Key Takeaways

EIG’s Catherine Lyons kicked off the webinar by sharing the latest OZ updates and resources, including insights gleaned from a recent survey of OZ stakeholders. Rachel Reilly of Aces & Archers then provided an overview of known OZ investments in affordable and workforce housing, highlighting project examples from across the nation.

Guest speakers then discussed their efforts to expand affordable housing for extremely- and very-low income households through The Emerald Affordable Housing OZone Fund. Karen Przypyszny from the National Equity Fund, Inc. (NEF) and Anne Simpson from Silicon Valley Bank (SVB) shared details about the process to structure the $110 million Opportunity Fund as well as investment activity that has occurred since the fund closed in August 2021. To-date, the fund has supported four transactions to create affordable homes in California’s high-cost cities and for some of the state’s most vulnerable populations. All projects included OZ equity and either 9 percent LIHTC or 4 percent LIHTC subsidy.

Projects funded to-date through The Emerald Affordable Housing OZone Fund:

- 425 Auzerais in San Jose, California

- 130 homes for those earning 30 – 60 percent of Area Median Income (AMI).

- 64 of which are permanent supportive housing (PSH) for formerly homeless individuals.

- Caritas Homes Phase I in Santa Rosa, CA

- 64 homes for those earning 20 – 50 percent of AMI.

- 30 of which are dedicated to formerly homeless families.

- 803 E. 5th Street in Los Angeles, California

- 95 homes for those earning 20 percent of AMI.

- All homes are PSH units dedicated to formerly homeless individuals.

- Coachella Valley Apartments in Coachella, California

- 56 homes for those earning 30 – 60 percent of AMI.

- All homes are targeted to low-income families and farmworkers.

Przypyszny and Simpson shared insights on why affordable housing developers should seek out OZ financing for their LIHTC projects. They also discussed some of the barriers to scaling this model such as aligning the timing of LIHTC projects with the capital deployment deadlines mandated by the OZ policy, and the expiration of certain OZ tax benefits.

Resources Discussed

- Webinar Recap: Opportunity Zones Market Update (March 2022)

- Local OZ incentives

- The Biohealth Opportunity Zone Incentive Program in Montgomery County, Maryland.

- Fee waivers for housing development projects located in Fresno, California’s infill OZs.

- Examples of affordable and workforce housing projects

- Bozeman Developers Plan ‘Missing Middle’ Apartments within Opportunity Zone (article)

- First Homes Selling in Kachina Village’s Newest Pocket Neighborhood (article)

- Avanath Acquires First Opportunity Zone Property (article)

- HVAF of Indiana, Woda Cooper Break Ground on 61-Unit Affordable Housing Community in Indianapolis (article)

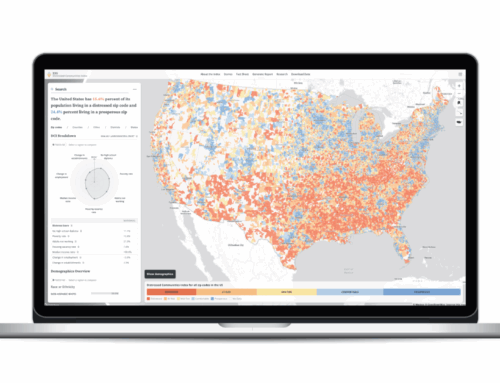

Visit EIG’s OZ Resources webpage for additional information including deal profiles, mapped activity, and recordings of previous webinars.