By Kennedy O’Dell

The U.S. Census Bureau’s Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis evolves. This analysis primarily covers data from June 21st to July 4th.

Here are five things we learned about the small business economy last week:

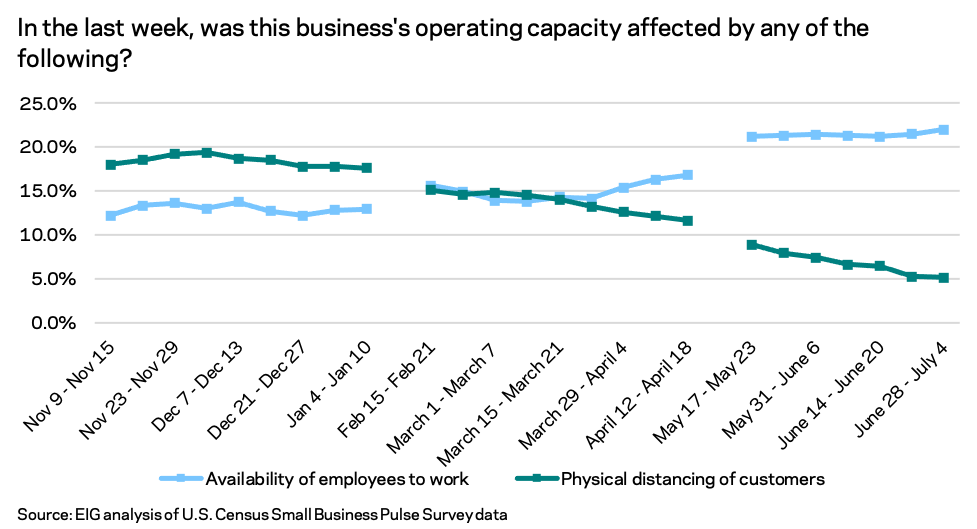

- Small businesses are feeling the labor market squeeze and it is having real effects on operating capacity, now more than at any other point recorded in the pandemic. The week of June 28th, 22.0 percent of businesses reported that the availability of workers was affecting their operating capacity. That share is significantly higher in the accommodation and food services sector at 51.4 percent. Until late March, physical distancing and limits on the number of customers was the leading factor mediating businesses’ operating capacity. Since then, the availability of workers has taken over as the leading limitation as restrictions ease and reopenings progress.

Small businesses are expressing a desire to continue staffing up to alleviate this pressure on capacity, although time will tell how quickly job matches can occur. Nationally, 35.6 percent expect to need to hire new employees in the next six months and that share rises to 51.7 percent in the accommodation and food services sector.

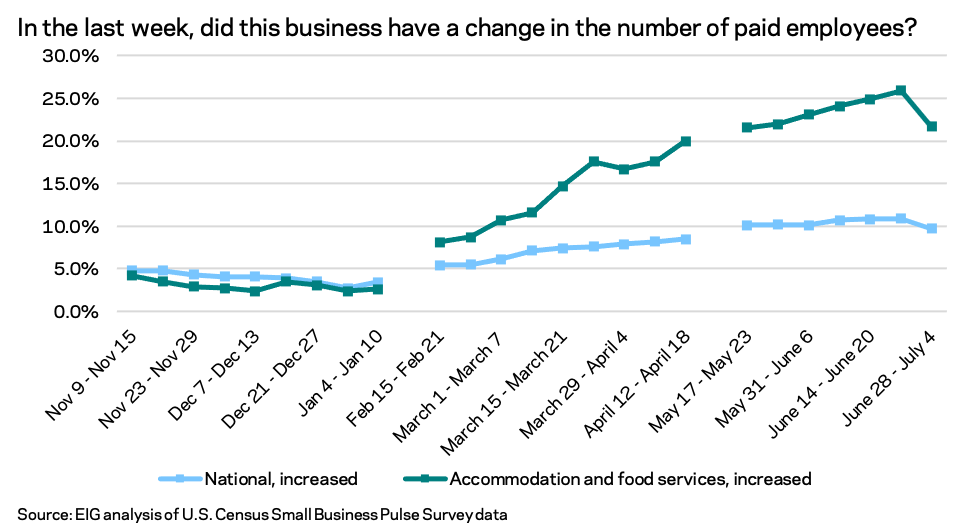

Small businesses are expressing a desire to continue staffing up to alleviate this pressure on capacity, although time will tell how quickly job matches can occur. Nationally, 35.6 percent expect to need to hire new employees in the next six months and that share rises to 51.7 percent in the accommodation and food services sector. - The staffing surge in the accommodation and food services sector took a step back last week, but over 20 percent of surveyed small businesses in the sector still added staff. National hiring figures were down slightly as the country moved into the holiday weekend, with the staffing surge in the accommodation and food services sector taking the biggest hit as the share of businesses in the sector reporting adding new employees fell from 25.9 to 21.7 percent over the week. A host of other sectors from construction and manufacturing to professional services and finance and insurance also backslid, with smaller shares of firms in each industry adding employees the week of June 28th than the previous week. Despite the downtick, more small businesses still reported adding employees (9.7 percent) than reported cutting them (8.4 percent).

- The Northeast is leading the national staff up, with the parts of the Midwest close behind. Four of the top 10 states with the highest share of small businesses adding employees in recent weeks are in the Northeast, a positive sign for that region’s late-coming recovery. Meanwhile, across the Deep South, more businesses were cutting employees than adding them in the week of June 28th. This souring in the Deep South is a recent development and one that could undercut the region’s recovery if it persists. The Northeastern states may be among those with the greatest amount of ground to make up in terms of the labor market given the sustained distress in the region broadly at the beginning of the pandemic, but this may not fully explain the geographic variation. It will be important to monitor how the geography of recovery evolves as the Northeast completes its catch up and new dynamics, such as vaccination rates, come to dictate trends.

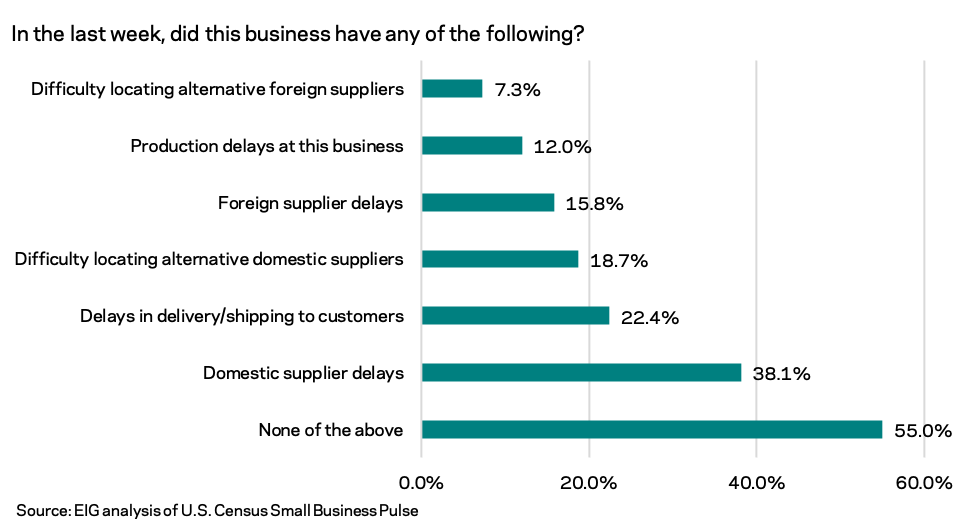

- Transportation delays on both the supply and delivery side show little sign of abating. The share of surveyed small businesses experiencing domestic supplier delays remained around 38 percent the week of June 28th while foreign supplier delays continued to affect just under 16 percent of respondents. Companies are also having trouble getting their products out to customers, with more than one in five (22.4 percent) reporting delays in delivery or shipping to customers.

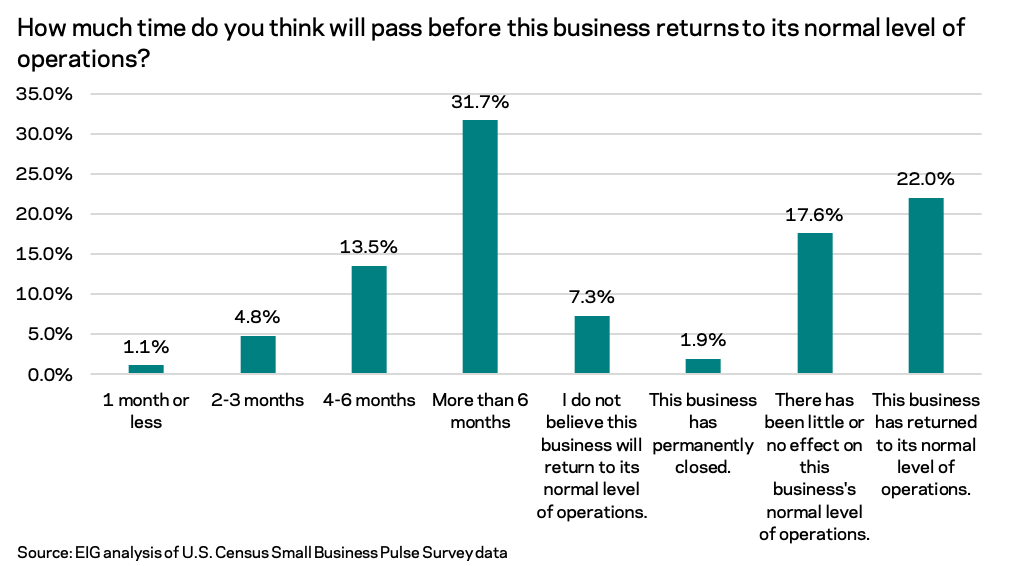

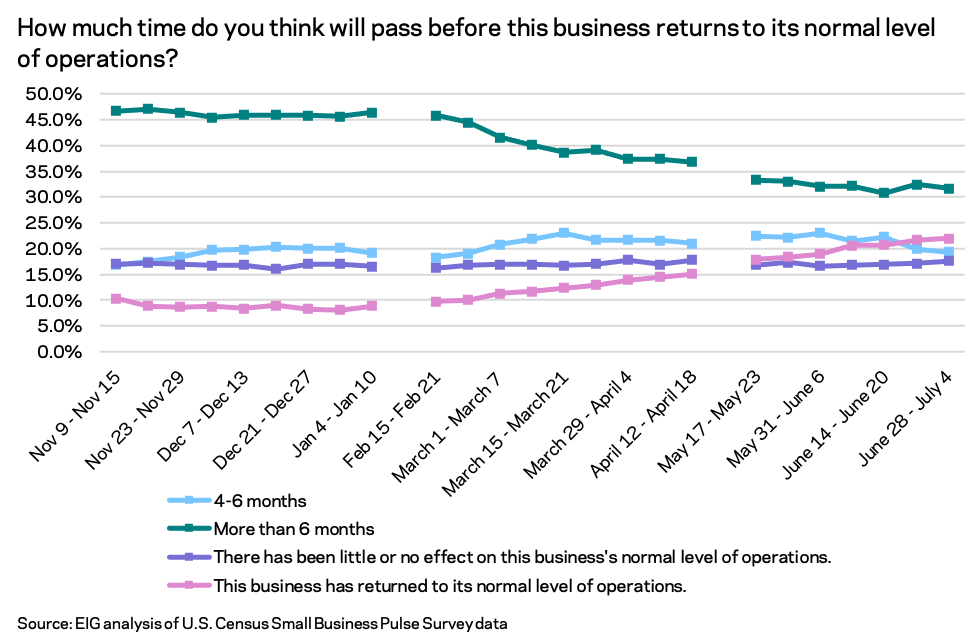

- The share of businesses who have returned to their normal level of operations has climbed steadily in recent months, although a concerningly large segment of the small business economy remains far from full recovery. Since mid-February, an increasing share of firms have moved towards recovery, with the share of businesses reporting a return to normal operations climbing from 9.8 percent to 22.0 percent by the week of June 28th. Meanwhile, over 30 percent of small businesses continue to expect a full return to normal levels of operation to take more than six months. Underlying trends in recovery expectation shifts vary by sector, but nationally the share of businesses expecting the return to their normal to take longer than six months still exceeds the share that have already returned to normal.