By Kennedy O’Dell

The U.S. Census Bureau’s Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds. This analysis covers data from April 5th to April 18th, the final two week period before this round of the survey sunsets.

Here are five things we learned about the small business economy last week:

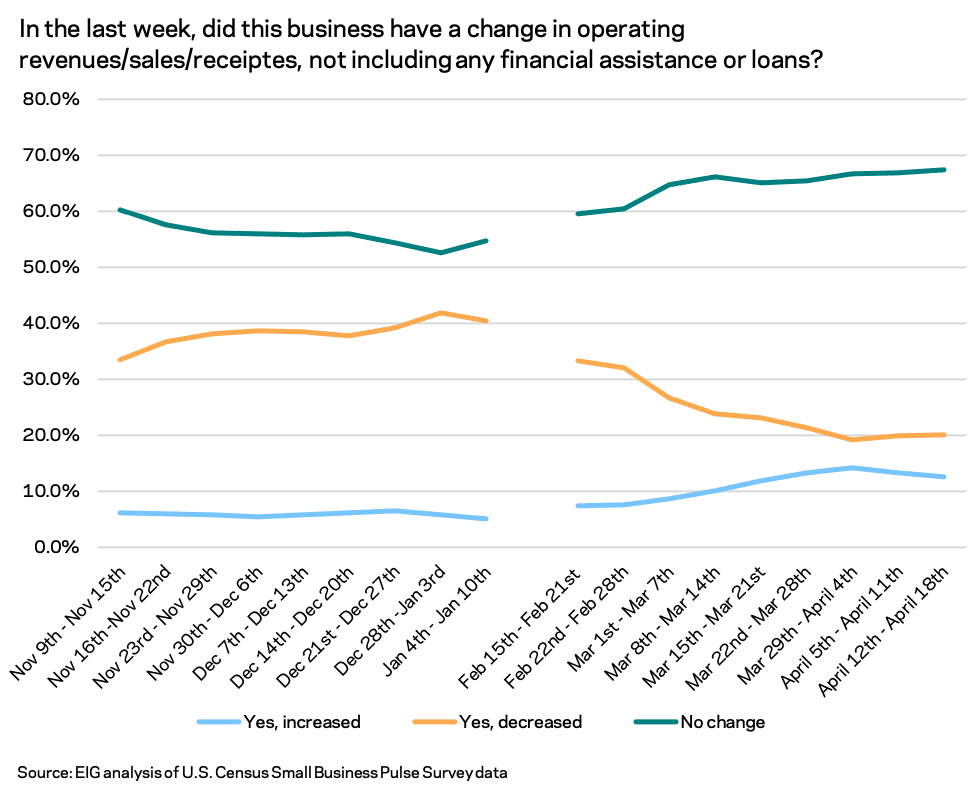

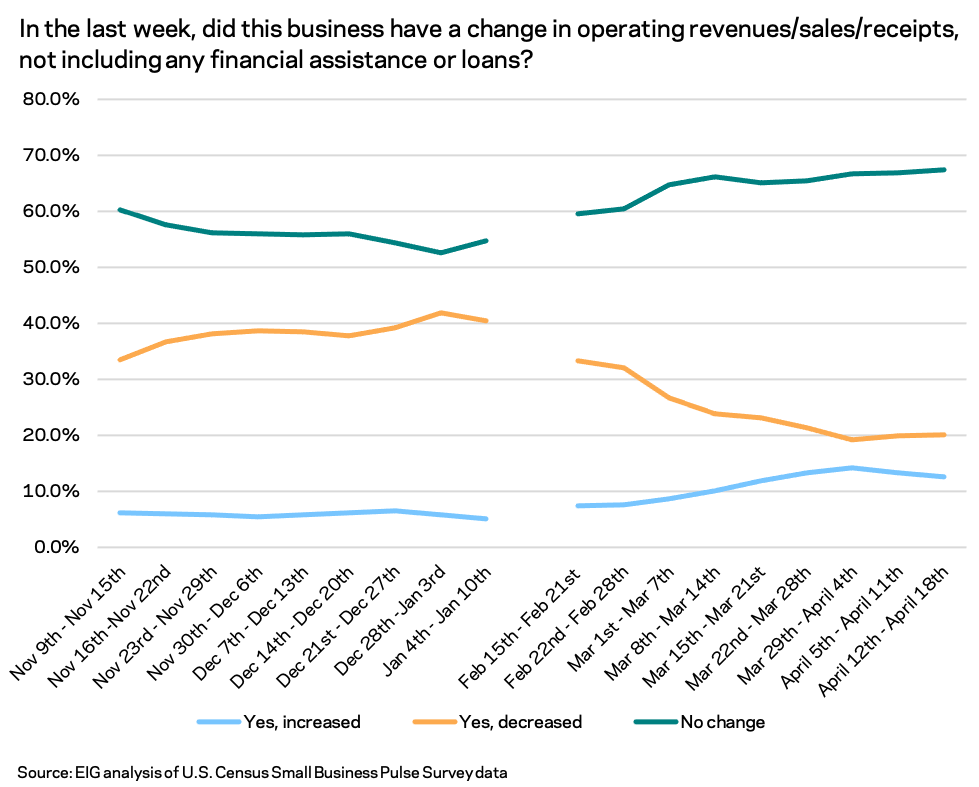

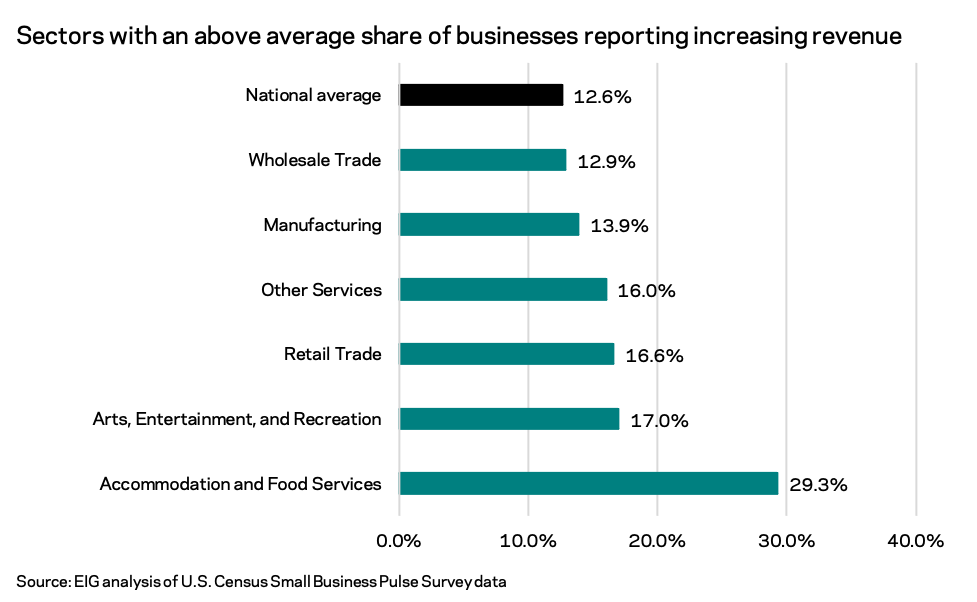

- The recovery in small business revenue growth seems to be plateauing. While the gap between the share of firms reporting decreasing revenues and those reporting increasing revenues has narrowed significantly in recent months, the share of firms decreasing revenue remains higher and both shares show signs of stabilizing. Two out of three businesses reported no change in revenues or sales the week of April 12th, while 20.1 percent reported decreased revenues and 12.6 percent reported increasing revenues. The share of firms reporting decreasing revenues fell steeply from mid-February to mid-March but has stabilized around 20 percent in recent weeks. The extent of continued revenue declines suggests that many small businesses are struggling to fully ride the broader national economic recovery.

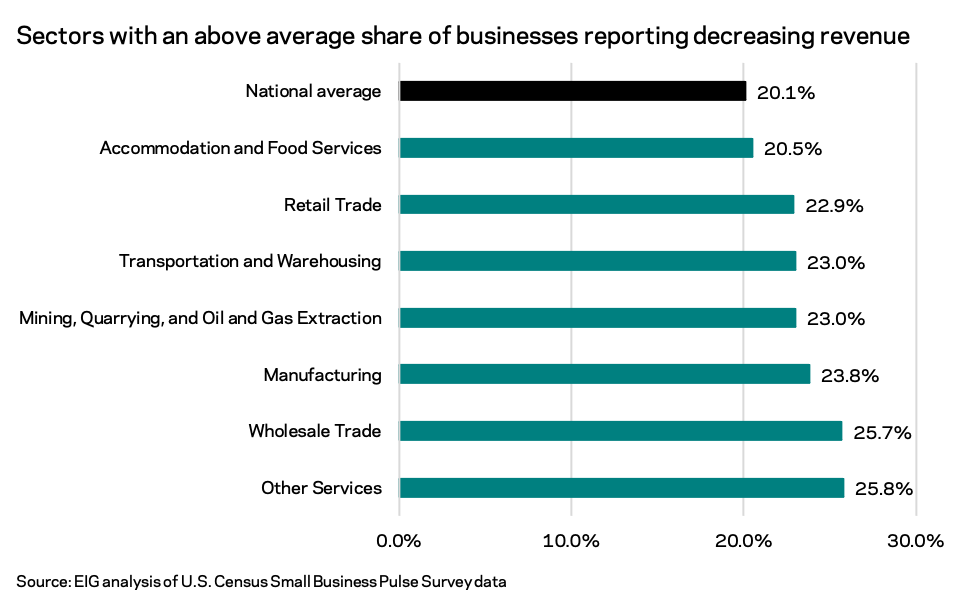

The sectors with the highest shares of firms increasing revenue are some of those hit hardest by the pandemic including accommodation and food services and arts, entertainment, and recreation. Some of the sectors with the highest share of firms decreasing revenue are the wholesale trade and manufacturing sectors.

The sectors with the highest shares of firms increasing revenue are some of those hit hardest by the pandemic including accommodation and food services and arts, entertainment, and recreation. Some of the sectors with the highest share of firms decreasing revenue are the wholesale trade and manufacturing sectors.

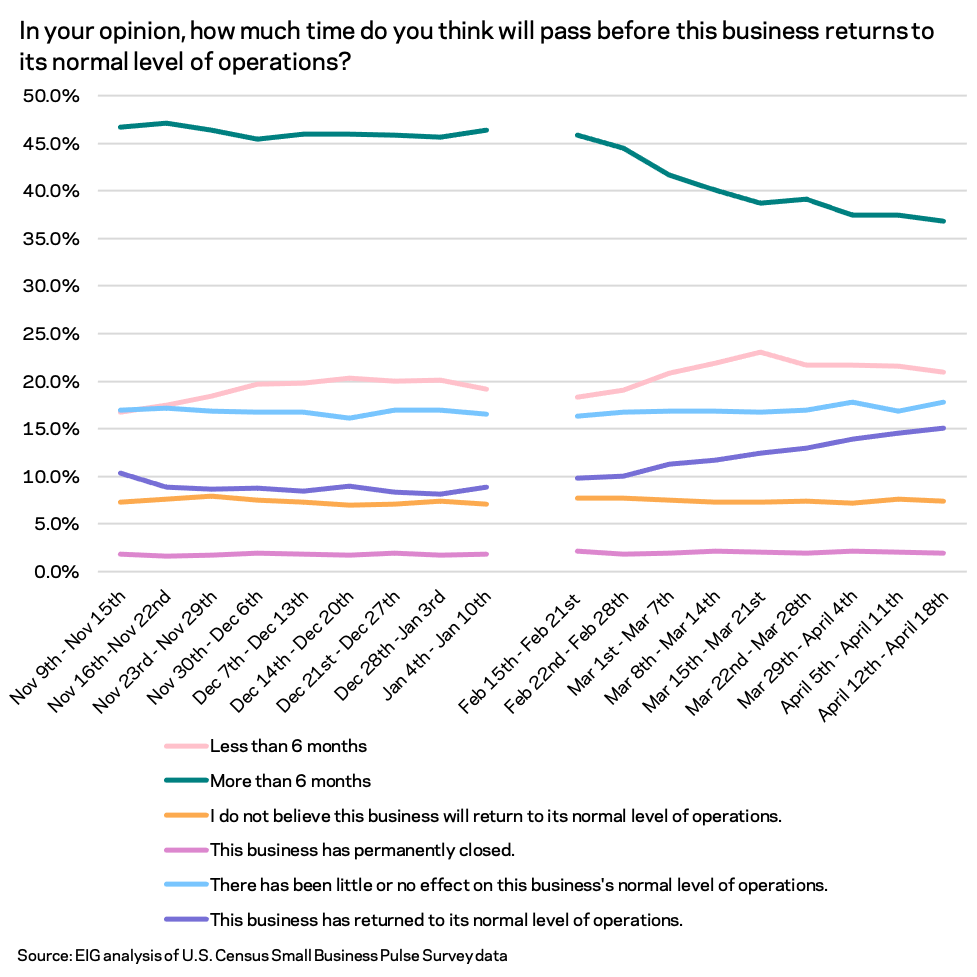

- Even as the recovery begins to take hold, over one-third of businesses expect more than six months to pass before they return to their normal level of operations. The share of businesses expecting recovery to take six months or longer has continued to meander downwards in the past month, but expectations are no longer improving at the same speed they did from mid-February to mid-March. The slowing improvement in recovery expectations is a caution against unabashed optimism for small businesses in the months ahead.

- For the fourth consecutive week, more businesses across the nation added paid employees than cut them. Over eight percent of surveyed small businesses added employees the week of April 12th. When it comes to employee hours, roughly the same share of businesses added employee hours as cut them (9.8 percent increasing, 10.2 percent decreasing). As with most of the pandemic, the majority of businesses reported neither increasing or decreasing hours or employees.

- A mix of high-population states and uniquely hard-hit small states continue to have the worst recovery outlooks. The speed and quality of the national recovery may be hampered by persistent distress in large states like New York, California, and Texas. Fortunes vary widely within regions, with less dense states tending to outperform their denser regional counterparts. The Northeastern states cluster among those with the largest share of businesses reporting a large negative effect of the pandemic while the South and the Midwest are generally more middling. In the West, California, Hawaii, and Alaska are among those hardest hit while Western interior rural states fall on the opposite end of the spectrum.

- Very few small businesses are requiring proof of vaccination before employees physically come to work. Nationally, 7.5 percent of businesses required a negative COVID test before employees could physically come to work while only 2.5 percent required proof of vaccination. With larger swaths of the population becoming vaccinated but some worry over vaccine uptake and shots in arms slowing over the past week, the share of businesses requiring proof of vaccination will be a key indicator to monitor. As efforts to combat vaccine hesitancy in the remaining population intensify, some may call on businesses to drive the vaccination push by requiring employees to be vaccinated to enter the workplace.