By Kennedy O’Dell

The U.S. Census Bureau’s Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds. This analysis covers data from the week of January 4th to January 10th.

Here are five things we learned about the small business economy last week:

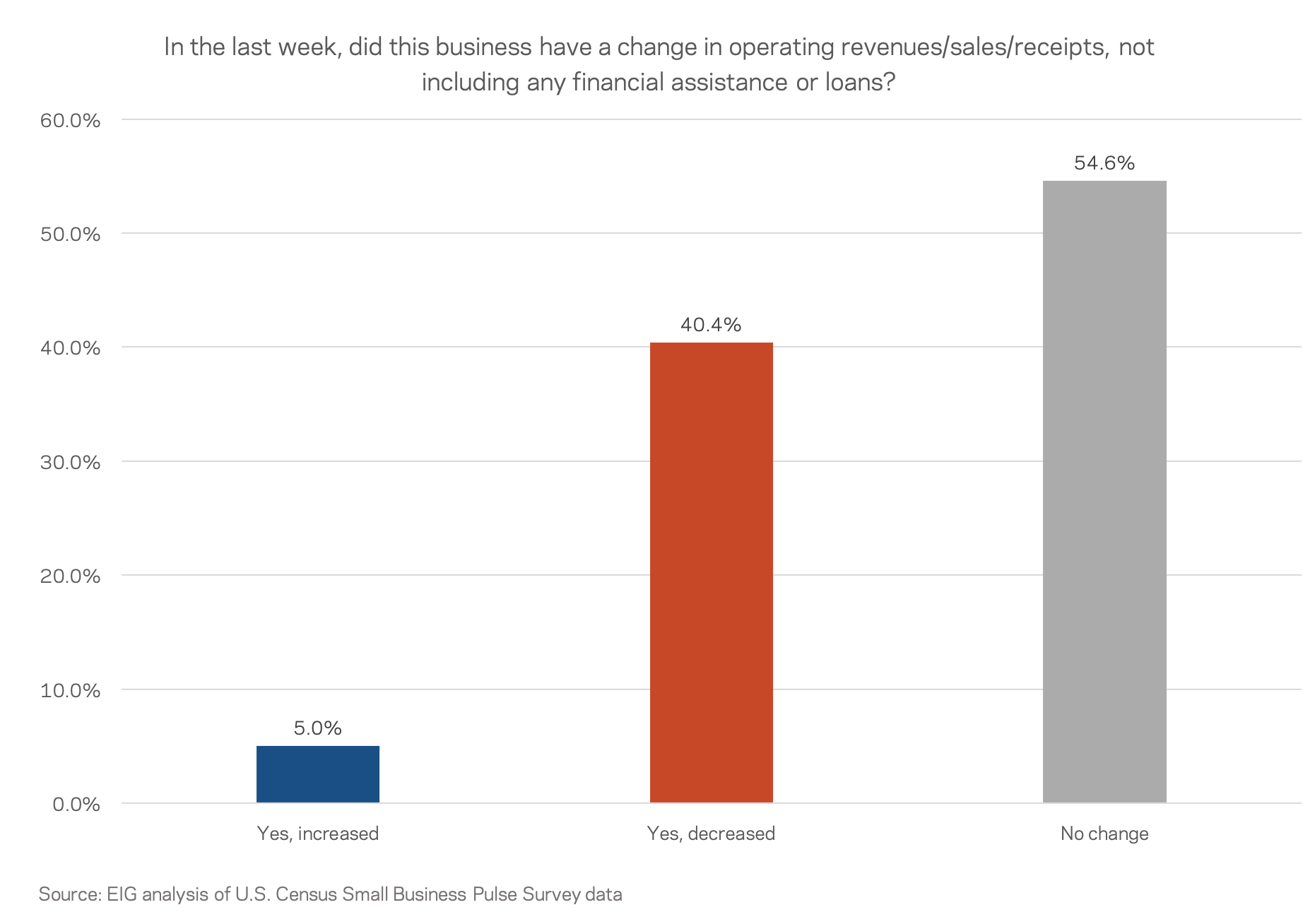

- Last week, 40 percent of surveyed small businesses experienced a decline in revenue and only 5 percent saw an increase. For the second week in a row, four out of every 10 small businesses experienced a decline in revenue. Amidst these falling margins, 12.4 percent of businesses cut employees, moving additional people out of the workforce. The sustained level of job cuts—over 10 percent of surveyed businesses have cut employees every week since mid November—is proving to have high costs for the American economy as the number of individuals filing initial unemployment claims climbed to 965,000 last week.

- 54.8 percent of small businesses nationally have not furloughed or laid off any paid employees since March 13, 2020. Workers in the utilities, finance and insurance, and real estate sectors are most immune to layoff or furlough while workers in the accommodation and food services, healthcare and social assistance, as well as arts, entertainment, and recreation sectors are most at risk. The relatively high share of businesses reporting no furloughs or layoffs since the start of the pandemic highlights how large parts of the economy remain relatively insulated from its worst economic effects.

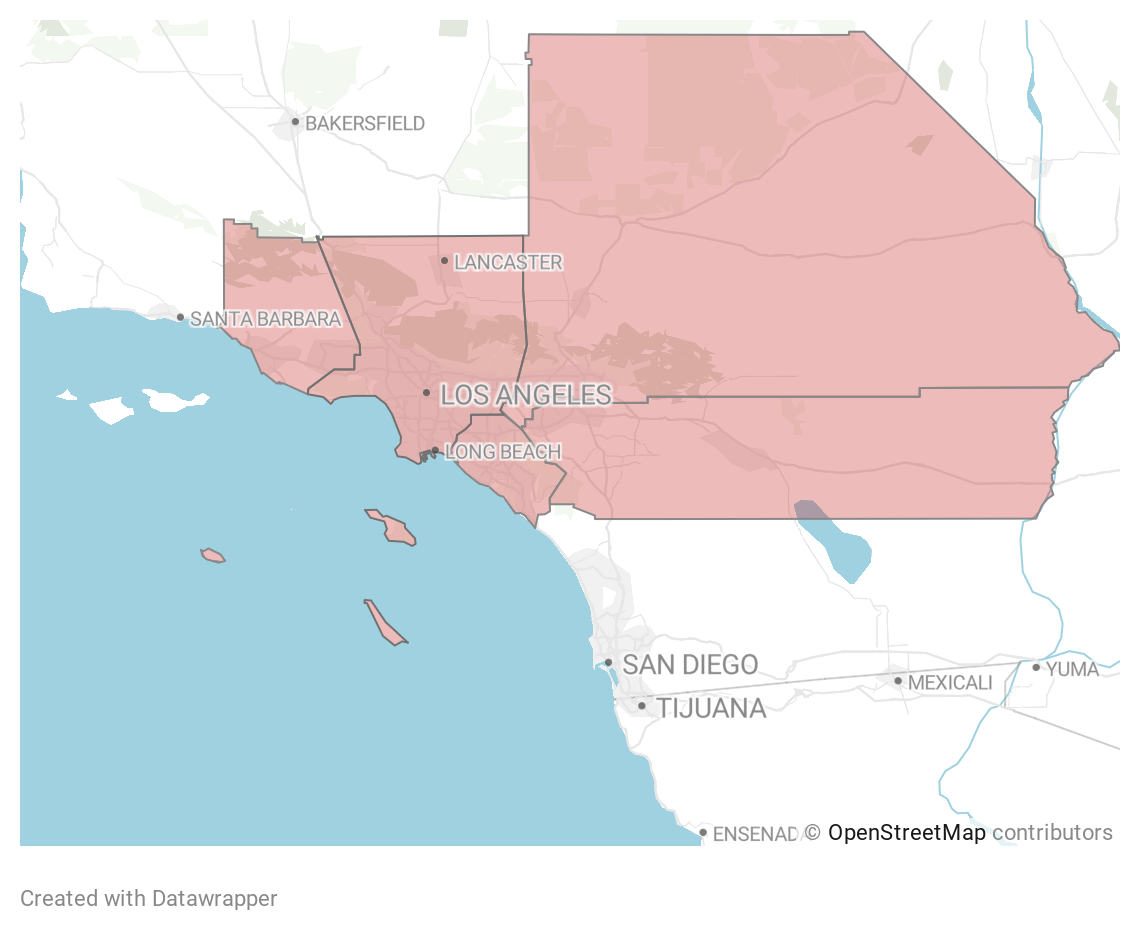

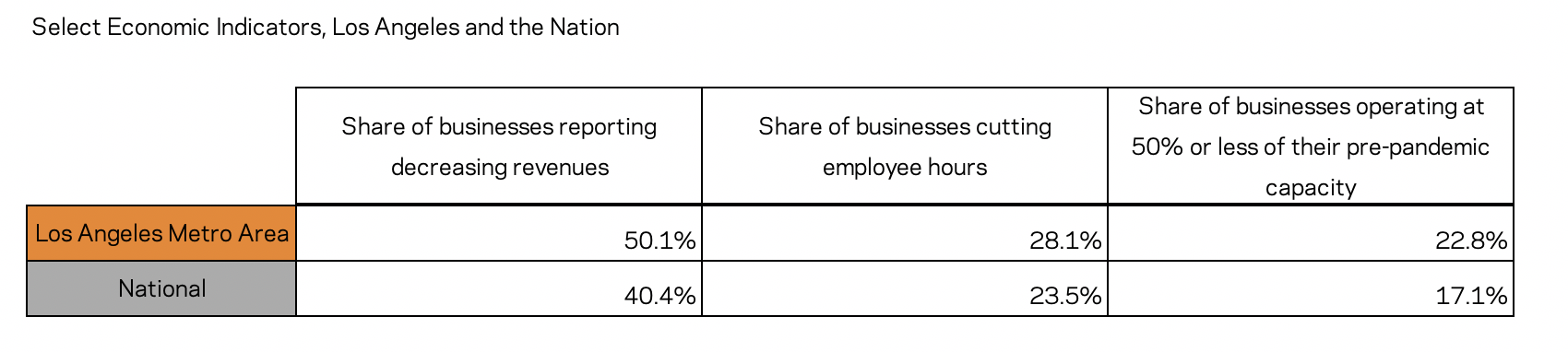

- In virus-stricken Los Angeles, the small business economy is in peril. Half of surveyed small businesses reported decreasing revenues the week beginning January 4th, 28 percent cut employee hours, and one in five businesses (22.8 percent) reported operating at 50 percent or less of their pre-pandemic capacity. County scientists estimate that one out of every three residents of Los Angeles County, or more than 3 million people, have been infected with COVID-19.

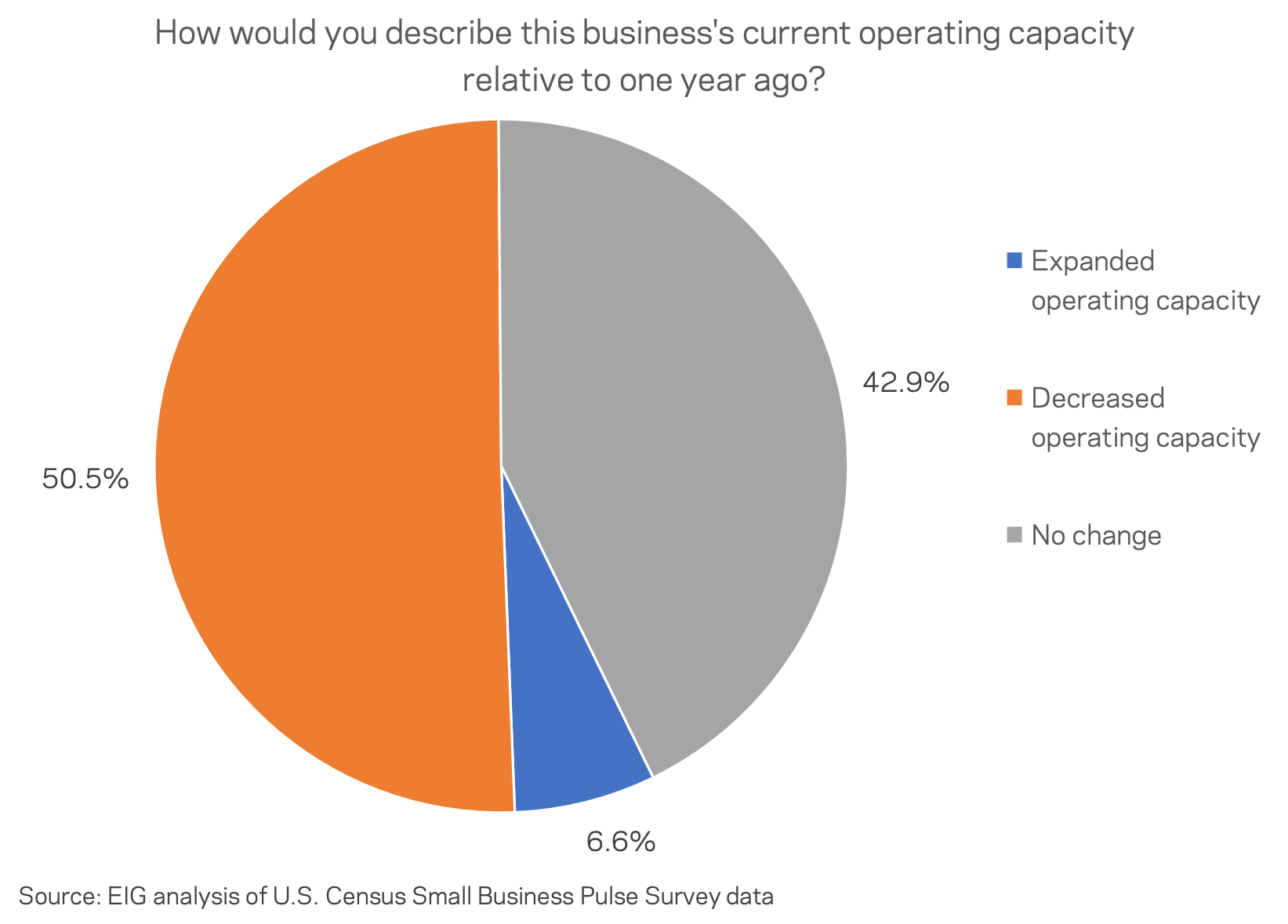

- In the midst of a renewed downturn, a small share of small businesses are finding opportunity. Nationally, 6.6 percent of firms have expanded their operating capacity relative to a year ago. While promising, the share is quite slim compared to the 50.5 percent who are operating at decreased capacity. The share of businesses reporting increased capacity tops 10 percent in only one sector: retail trade. Roughly twelve percent of businesses in the retail trade sector have increased their capacity relative to a year ago.

- The Census Bureau’s Small Business Expected Recovery Index has not improved for eight straight weeks. The index, which provides a measure of how small business sentiment is shifting with respect to recovery expectations, has flatlined. After improvements in August and September that pointed to increasingly positive recovery outlooks, the measure dipped back down in November and then stalled out. The index does not yet show business recovery expectations souring strongly but instead underscores the lack of improvement in outlook despite the beginning of vaccine rollout and the promise of additional stimulus.