By Kennedy O’Dell

The U.S. Census Bureau’s Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds. This analysis covers data from the week of December 28th to January 3rd.

Here are six things we learned about the small business economy last week:

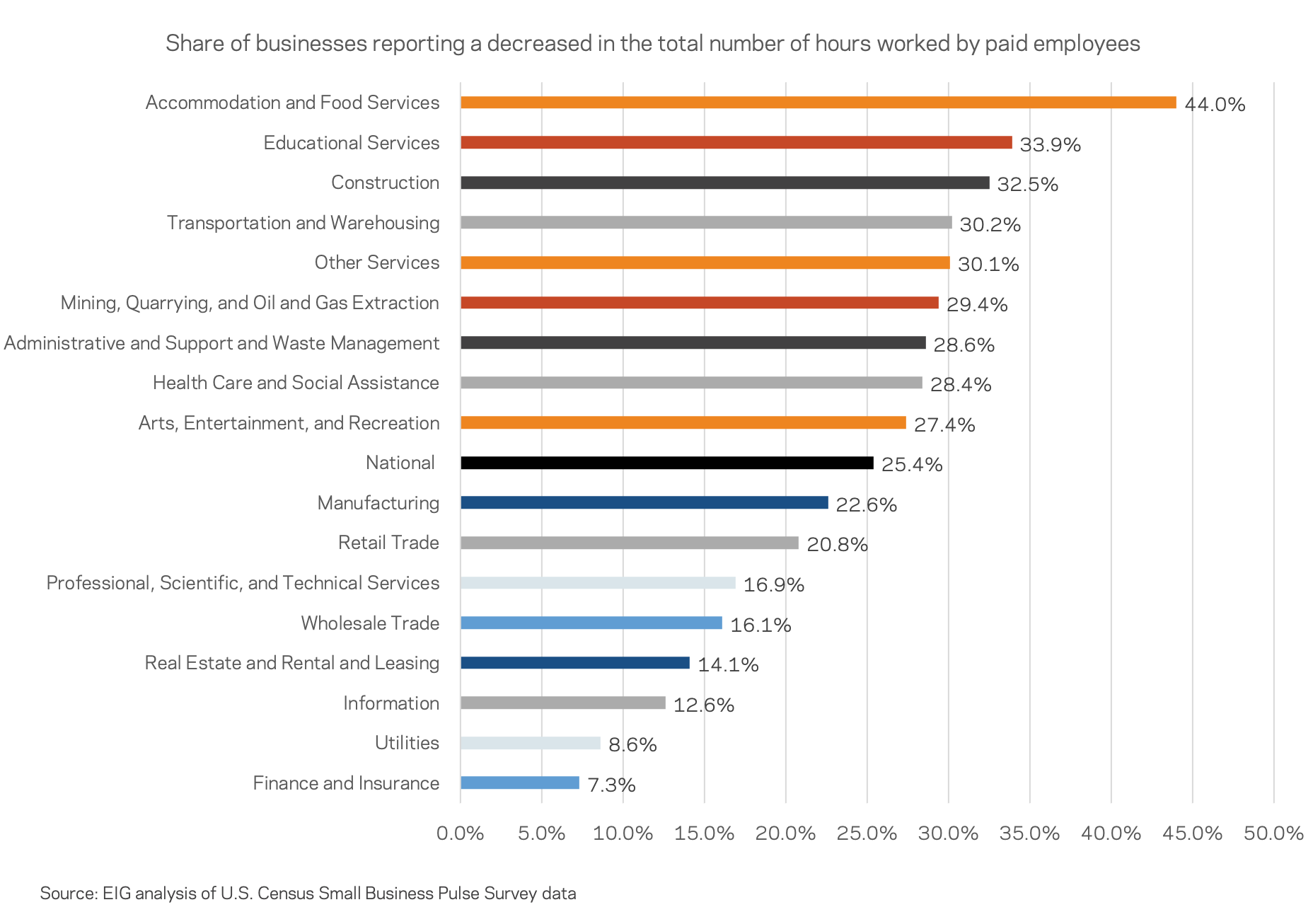

- One in four businesses cut employee hours last week, the highest recorded share since early June. In the week ending January 3, 2021, 25.4 percent of businesses decreased employee hours. Nine sectors reported above average shares of businesses cutting hours, with accommodation and food services (44.0 percent), educational services (33.9 percent), and construction (32.5 percent) running highest. The surge in hour cutting does not appear to be driven by the passing of the holidays: the retail trade sector, a central sector for seasonal hiring, actually saw a smaller share of businesses cut hours than the national average.

- As the virus raged in the final weeks of 2020, the share of businesses expecting to need to obtain financial assistance or additional capital in the next six months in order to survive broke 30 percent and continued to rise. After ticking down in August and September, the share of businesses expecting to need to obtain financial assistance or additional capital in the next six months rose in the final weeks of 2020. The spike in need coincided with Congressional deliberations on a second stimulus package which ultimately included a second round of PPP funding.

- The long-awaited arrival and rollout of coronavirus vaccines has not changed the recovery expectations of small business owners. The share of businesses expecting a return to normal operations to take more than 6 months remained stable around 46 percent through December meaning that, as of yet, a plurality of small business owners still anticipate a slow and steady climb back to recovery. The stability of that figure as months elapse may reflect two potential realities. First, the lion’s share of businesses in that category may expect eventual recovery but over a period much longer than 6 months, effectively falling well into the “more” side of things. Beyond that, the stability may also reflect businesses continually shifting their recovery expectations outward, a kind of negative expectations change underneath the topline stability.

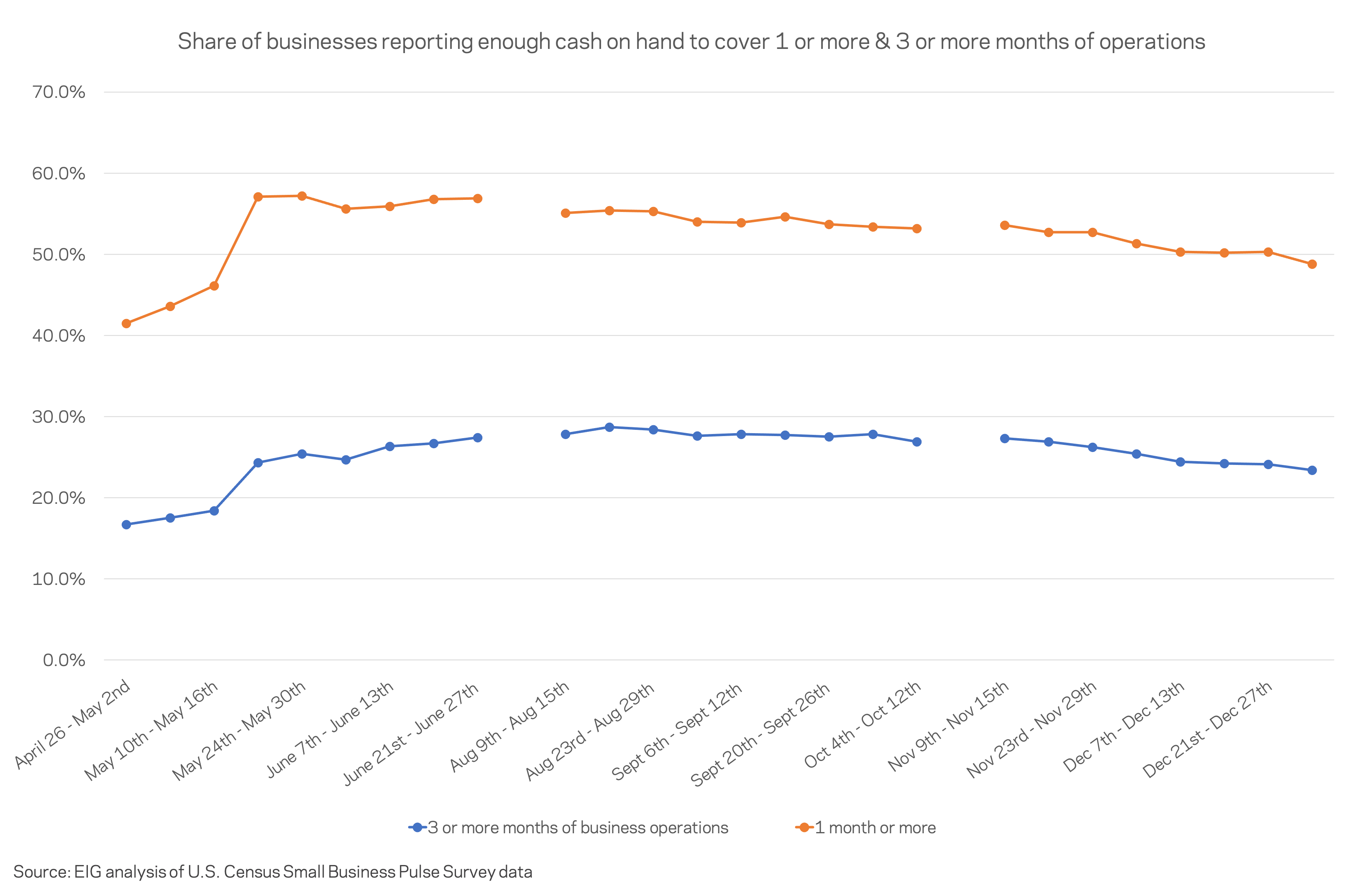

- Cash on hand surged after the relief included in the CARES Act entered the small business economy, but small businesses’ reported cash cushions have dwindled in recent months. In early May, the share of businesses reporting enough cash on hand to cover over one month of business operations stood at 41.5 percent. After the distribution of PPP and other programs in late May, that figure rose dramatically, with the share of businesses with enough cash on hand to fund three or more months of operations stabilizing between 27 and 29 percent in the late summer and fall. Recently, the share with enough cash on hand to cover more than a month has fallen to its lowest level since before the effects of the first stimulus package took hold in late May.

- Pandemic distress appears to be “sticky” – states with the highest share of businesses reporting a large negative effect remain little changed between May and December. While there are some notable exceptions, the fallout from the economic crisis continues to be felt particularly strongly in many of the same states that struggled early in the pandemic including DC, New York, Hawaii, New Jersey, California, and Illinois. Notable states that have bounced back from a tough initial outlook include Michigan and Washington, while Texas, New Mexico, and Alaska have moved in the opposite direction. This trend supports previous EIG analysis that found that many of the states continuing to report the biggest impact of the pandemic were largely those hit early by the virus and those with an economy structured around the hardest hit sectors.

- As with distress, those states with the largest share of businesses who appear to be generally impervious to the effects of the pandemic were largely the same at the end of the year as in May. The interior West and the Plains states continue to have the largest shares of their business communities reporting little to no effect of the pandemic while the Northeast and coastal West fall on the opposite end of the spectrum.