By Kennedy O’Dell

The U.S. Census Bureau’s Small Business Pulse Survey provides weekly insight into the condition of the country’s small business sector as this unprecedented economic crisis unfolds. This analysis covers data from the week of December 7th to December 13th.

Here are six things we learned about the small business economy last week:

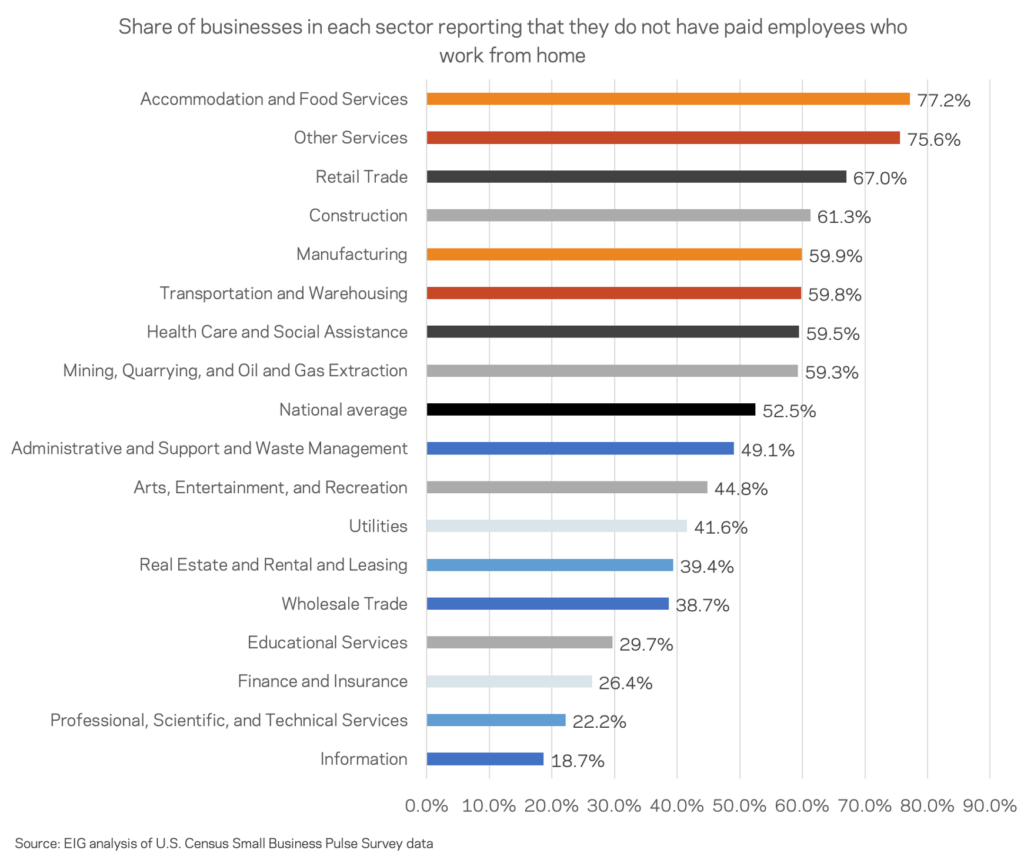

1. Working from home is a luxury afforded to few industries and to no industry completely. Even nine months into the pandemic, the majority of businesses surveyed do not have any paid employees who work from home. In the accommodation and food services sector, 3 out of 4 businesses report having no paid employees who work from home compared to just 1 out of 4 in the finance and insurance sector. Working from home has the greatest penetration in the white-collar professional services and tech-heavy information sectors.

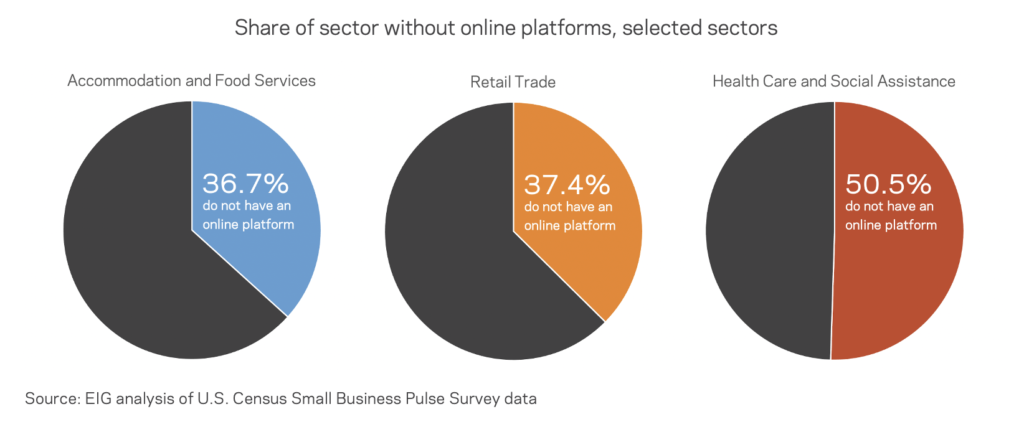

2. Despite a well-publicized transition to contactless consumption, over one-third of businesses in the accommodation and food services and the retail trade sectors do not have an online platform to offer goods or services heading into the height of the holiday season. While many small businesses have been able to adapt from in-person shopping or dining to curbside pickup or delivery, a significant portion of key sectors have not made the shift. Strikingly, half of the surveyed businesses in the health care and social assistance sector also report that they do not use online platforms to offer goods or services.

3. One in 10 surveyed business owners have turned to self financing over the course of the pandemic. Small business owners have turned to a variety of funding sources to secure assistance throughout the pandemic, one of which is their own personal finances. Roughly 11 percent of businesses report turning to self financing at some point since March 13, 2020. That share is larger than the total share of businesses who have turned to the Main Street Lending Program, Federal Sick and Family Leave Tax Credits, the Federal Employee Retention Tax Credit, and deferrals of federal employment tax deposits and payments combined. The sectors where self-financing is most common are accommodation and food services and educational services.

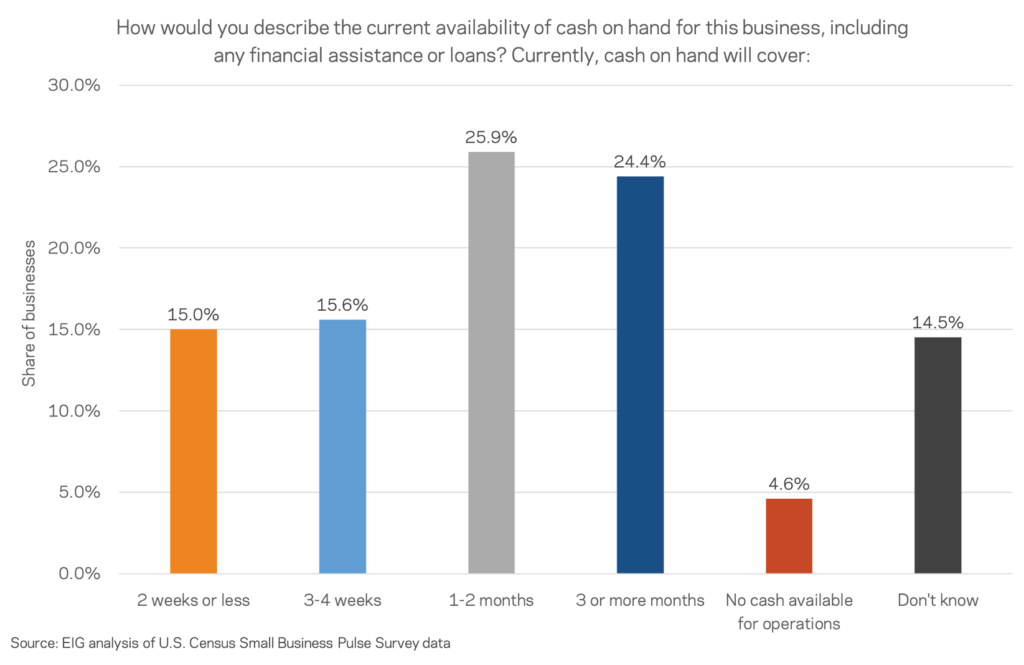

4. Cash on hand figures show only 24.4 percent of businesses have enough cash for 3 or more months of business operations, the lowest share since late May. The share has been largely stable for several months around 28 percent but has fallen as of late. Uncertainty also appears to be rising, as more small businesses now say they do not know how long their cash will last than did in June.

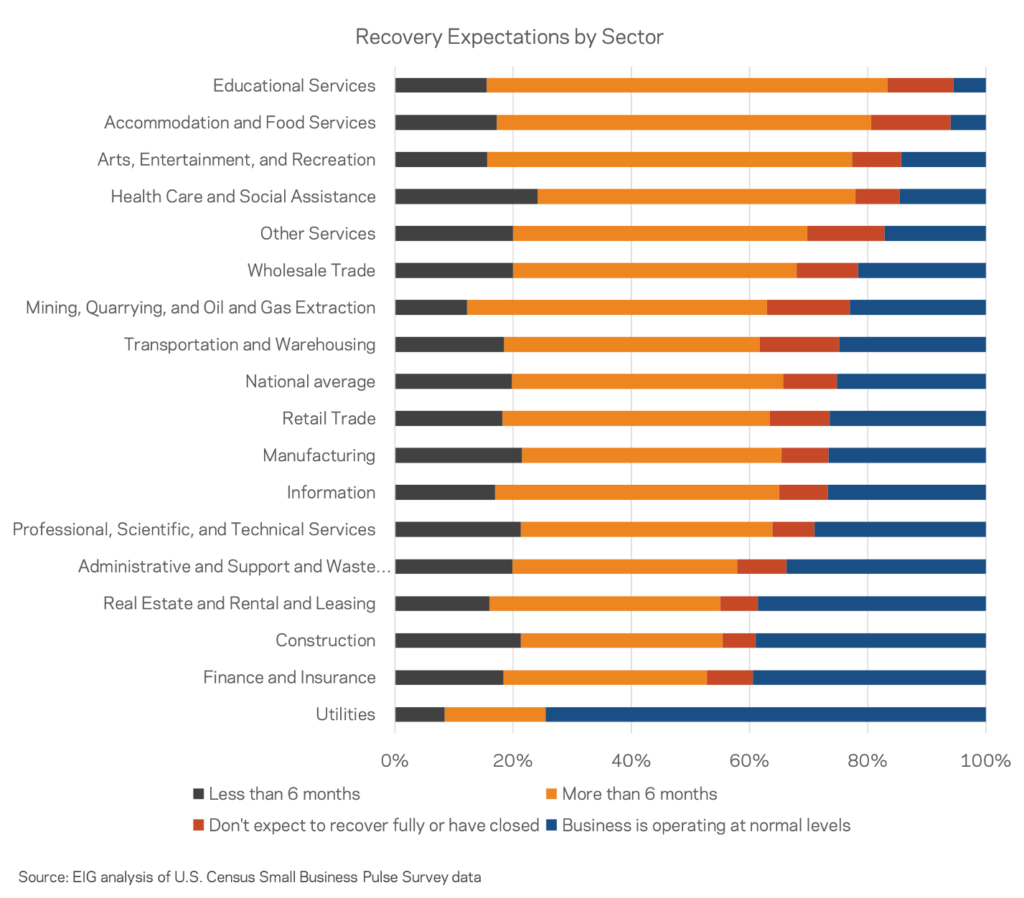

5. While some sectors are weathering the pandemic better than others, hardly any are close to being recovered. Nationally, only one-quarter of businesses are operating at their normal level of operations relative to a year ago. In only one sector, utilities, are even 40 percent of businesses operating at their normal level of operations relative to a year ago. The next best performing trio of sectors includes finance and insurance, construction, and the real estate sector, all of which have just under 40 percent of surveyed businesses operating at their normal, pre-pandemic level. For comparison, the worst performing duo of accommodation and food services and education both have less than ten percent of all businesses operating at pre-pandemic levels.

6. Revenue fell again last week for over 60 percent of businesses in the accommodation and food services sector. This was the fourth week in a row over 60 percent of small businesses in the sector reported further week-on-week revenue declines, suggesting that firms in the sector are actively falling deeper into fiscal distress as the pandemic’s surge takes its toll. By contrast, the share of businesses in the professional, scientific, and technical services sector experiencing revenue decline hasn’t topped 30 percent since mid-August.